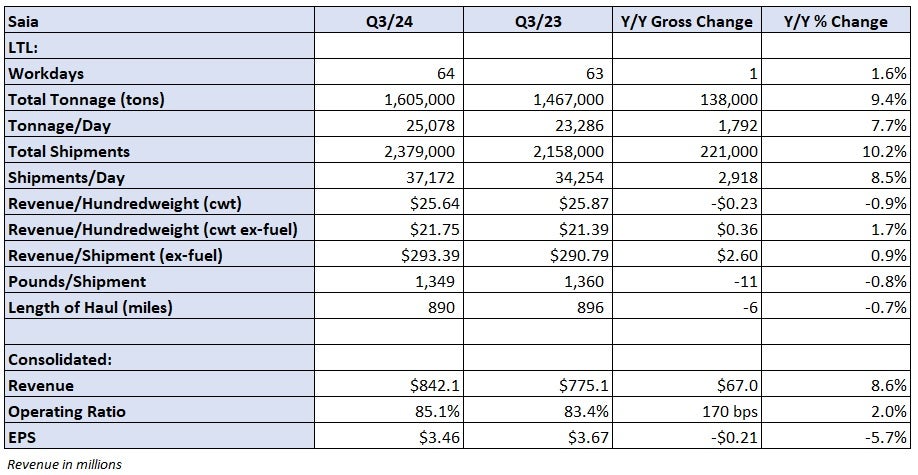

Less-than-truckload carrier Saia missed analysts’ third-quarter expectations on Friday, reporting earnings per share of $3.46. That was 7 cents light of consensus and 21 cents lower year over year.

Saia’s (NASDAQ: SAIA) revenue increased 8.6% y/y to $842 million. Revenue was up 6.9% y/y on a per-day basis. The per-day revenue increase was driven by a 7.7% increase in tonnage per day, partially offset by a 0.9% decline in revenue per hundredweight, or yield. Excluding fuel, yield was 1.7% higher.

The tonnage increase was driven by an 8.5% increase in shipments per day, which was partially offset by a 0.8% decline in weight per shipment. Saia has been one of the biggest beneficiaries of Yellow Corp.’s (OTC: YELLQ) July 30, 2023, shutdown. On a two-year stacked comparison, its tonnage is up 14.4%.

Saia reported an 85.1% operating ratio (operating expenses expressed as a percentage of revenue) in the quarter, which was 170 basis points worse y/y and 180 bps worse than the second quarter. The result was in line with management’s guidance of 100 to 200 bps of sequential deterioration.

“The freight backdrop in the third quarter remained muted, and while weight per shipment was essentially flat compared to the second quarter, we continue to experience [freight] mix headwinds compared to prior year,” Saia’s CFO Matt Batteh said in a news release.

The influx of freight to its network since Yellow’s shutdown has included a significant amount of lighter-weight, retail freight. The company is also contending with additional costs from opening new service centers, which take months to ramp to profitability. The news release said it will open 21 new locations this year in addition to relocating other terminals.

The company saw a nearly $5 million y/y swing from interest income to interest expense in the quarter as it took on debt to acquire the terminals. That was a 14-cent y/y drag on EPS.

Saia will host a conference call at 10 a.m. EDT on Friday to discuss third-quarter results.