Schneider National joined a chorus of transportation providers that recently lowered guidance for the rest of the year. The company reduced its earnings forecast by 13% at the midpoint of the range on Thursday.

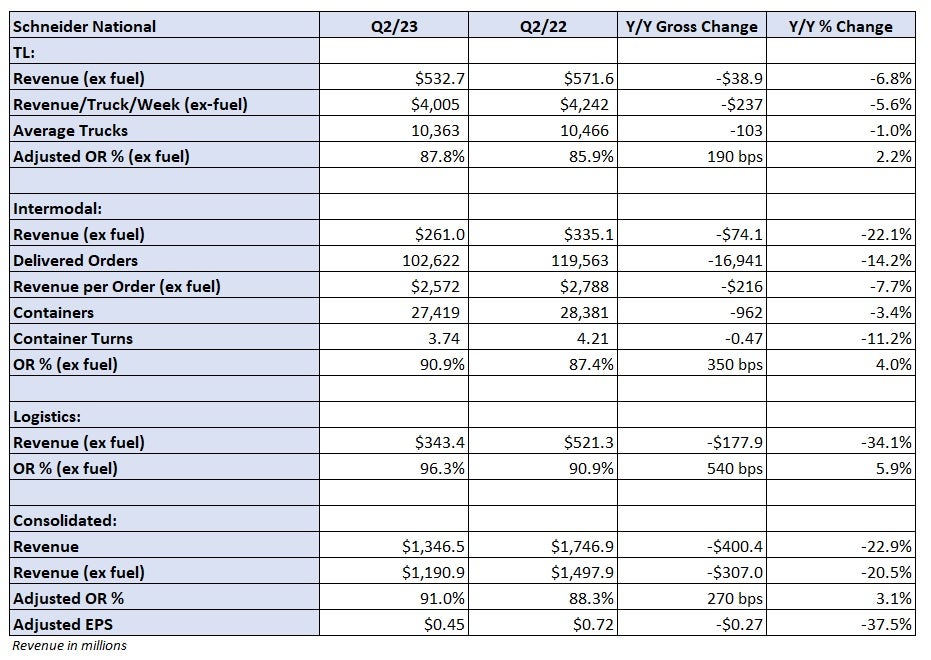

Schneider (NYSE: SNDR) reported adjusted earnings per share of 45 cents, a penny ahead of the consensus estimate but 27 cents lower year over year (y/y). The number included a 3 cent y/y tailwind from higher gains on equipment sales.

The company lowered its full-year EPS outlook to a range of $1.75 to $1.90 from $2 to $2.20. The new guidance was below the $1.98 consensus estimate at the time of the print. Softer than expected volumes and pricing were the reasons for the reduction.

The outlook calls for a slight sequential step down in EPS during the third quarter as the full impact of prior contractual rate negotiations will be felt. However, the fourth quarter should improve from that level as normal seasonality presents some project opportunities.

Gains on equipment sales were also front-half loaded this year as OEMs were able to catch up on deliveries. Falling demand from second-generation buyers due to sagging TL spot rates is having an impact on trade-in values.

The new guidance includes very modest accretion from its Tuesday acquisition of dedicated carrier M&M Transport, which adds 500 trucks to Schneider’s network.

Revenue in Schneider’s truckload segment fell 7% y/y to $533 million excluding fuel surcharges. Revenue per truck per week was down 12% in its one-way segment, which represents a little more than 40% of the total fleet. The utilization metric was flat in its dedicated unit.

A TL operating ratio of 87.8% was 190 basis points worse y/y and benefited roughly 150 bps from the y/y increase in gains on sale.

Intermodal revenue fell 22% y/y (excluding fuel) to $261 million as loads were down 14% and revenue per load was off 8%. Average container turns were down 11% y/y but improved slightly from the first quarter. The company said it paused container buying until the market turns.

The segment’s OR was 350 bps worse y/y at 90.9%.

Management expects a moderate peak season with some inventory restocking this year. It noted an atypical trend in July as both truck and intermodal volumes were slightly higher than in June, albeit off smaller bases than in years past.

Logistics revenue fell 34% y/y to $334 million (excluding fuel). Loads were off 10% with declines in revenue per load accounting for the remainder of the decline. The OR deteriorated 540 bps to 96.3%.

“We are navigating the current environment from a position of strength which enables us to remain focused on the strategic advancement of our multimodal portfolio and to capitalize on the eventual recovery,” said President and CEO Mark Rourke.

Shares of SNDR were up 2.3% at 1:53 p.m. EDT on Thursday compared to the S&P 500, which was off 0.1%.

More FreightWaves articles by Todd Maiden

- Forward Air starting to see impact from Yellow’s exit

- Abrupt layoffs center of lawsuit against Yellow

- Employees at Yellow Logistics terminated