Schneider National (NYSE: SNDR) reported strong third quarter earnings, announcing $1.3 billion in operating revenue, a 15 percent increase compared to the third quarter of 2017. Schneider CEO Chris Lofgren attributed much of the quarter’s strength to the company’s ability to weather market cycles effectively.

Revenues, excluding fuel surcharge, came in at $1.1 billion, a 13 percent increase over the third quarter of 2017. The company reported net income of $70.7 million, a 92 percent increase over the third quarter of 2017.

“Our portfolio of complementary services comprised of Truckload, Intermodal, and Logistics, delivered excellent results in the third quarter,” Lofgren said.“Given the continued tightness in driver availability, the company pivoted its capital allocation by adding containers to our Intermodal business, providing profitable enterprise growth in a less driver intensive business. We experienced solid revenue and earnings growth in our asset-light and non-asset business segments. Intermodal and Logistics combined to contribute 45 percent and 50 percent of the enterprise revenue and earnings, respectively, demonstrating the power of our portfolio across market cycles.”

Schneider’s diluted earnings per share and adjusted diluted earnings per share both climbed to $0.40 in the third quarter of 2018, up from $0.21 and $0.23, respectively, in the third quarter of 2017. Full year 2018 adjusted EPS guidance climbed from $1.47 to $1.53.

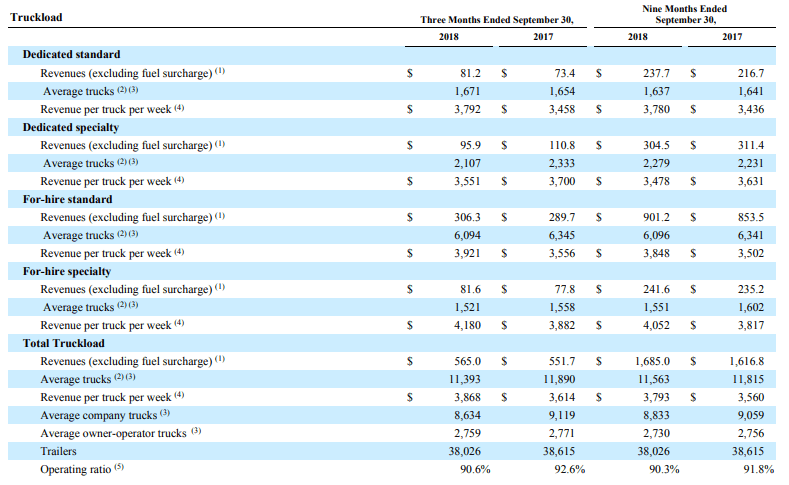

Truckload revenues, excluding fuel surcharge, came in at $565 million, a growth of 2 percent since the third quarter of 2017. Revenue per truck per week improved $254, or 7 percent, year-over-year, due to strength in contract pricing. Both for-hire standard and dedicated standard revenue per truck per week grew 10 percent compared to the third quarter of 2017.

Schneider’s truckload segment increased driver capacity and grew its trucks during the third quarter in preparation for fourth quarter volumes.The segment ended the quarter with over 11,550 trucks.

Income from truckload operations increased 29 percent year-over-year, coming in at $53.1 million. Schneider officials attributed this to contract price improvement, partially offset by higher driver pay, increased investments in driver recruiting and incremental First to Final Mile losses.

“The company’s FTFM business had a loss of $9.5 million in the third quarter of 2018 due to sluggish furniture and flooring volumes, a bankruptcy write-off and operational inefficiencies, which management is addressing,” Schneider’s earnings report reads. “FTFM negatively impacted Truckload segment operating ratio by approximately 300 basis points in the third quarter of 2018.”

Lofgren and Chief Operating Officer Mark Rourke assured analysts on the earnings call that the company has pinpointed the flaws in the FTFM business and is working to make it more efficient and profitable in the future.

Schneider’s intermodal revenues, excluding fuel charge, grew to $252.1 million, up 29 percent from the third quarter of 2017, thanks to an 11 percent growth in orders and a $299, or 16 percent, improvement in revenue per order.

“Orders grew compared to the same quarter in 2017 due to the conversion of over-the-road freight, the addition of more than 3,700 new containers and a 16% increase in company operated dray trucks,” the earnings report reads. “Container growth is the result of the company’s decision to allocate capital toward Intermodal in the current favorable environment.”

Intermodal income from operations increased 196 percent in year-over-year, due to volume and price growth, operational effectiveness and an improved cost position as a result of the 2017 conversion to owned chassis. Intermodal operating ratio was 85.7 percent for the third quarter of 2018, an improvement of over 800 basis points compared to the same period in 2017 and an 80 basis point improvement sequentially from the second quarter of 2018.

Logistics revenues, excluding fuel surcharge, came in at $268.7 million, a 29 percent increase compared to the third quarter of 2017, due to a brokerage volume growth of 20 percent and increased revenue per order thanks to a strong price environment. Brokerage made up 79 percent of logistics revenues in the third quarter of 2018, compared to the 74 percent in the third quarter of 2017.

Logistics income from operations increased 37 percent year-over-year, due to volume growth in brokerage and continued effective net revenue management, as evidenced by a 60 basis point improvement in logistics operating ratio sequentially from the second quarter of 2018.

Multiple analysts on the call asked why data has not shown more of a peak season surge, but Schneider officials insisted the current market is positive and it is not unusual to see the peak season surge begin toward the end of the first week of November, so there is still time for an uptick.

Schneider’s EPS was in-line with estimates, while its revenue beat expectations. The company’s stock was up 4.57 percent as of 3:50 p.m. Thursday.