Management from Schneider National said Thursday that in spite of a recent cooling in truckload demand, it remains positive on the back half of the year.

“As strong as the second quarter was, we did observe signs of moderation in freight market conditions as the quarter progressed, consistent with industry narrative,” Mark Rourke, CEO and president, stated in a news release. “However, we continue to expect a constructive freight environment for the remainder of 2022, including a return of seasonality, starting with fourth of July holiday and back-to-school demand.”

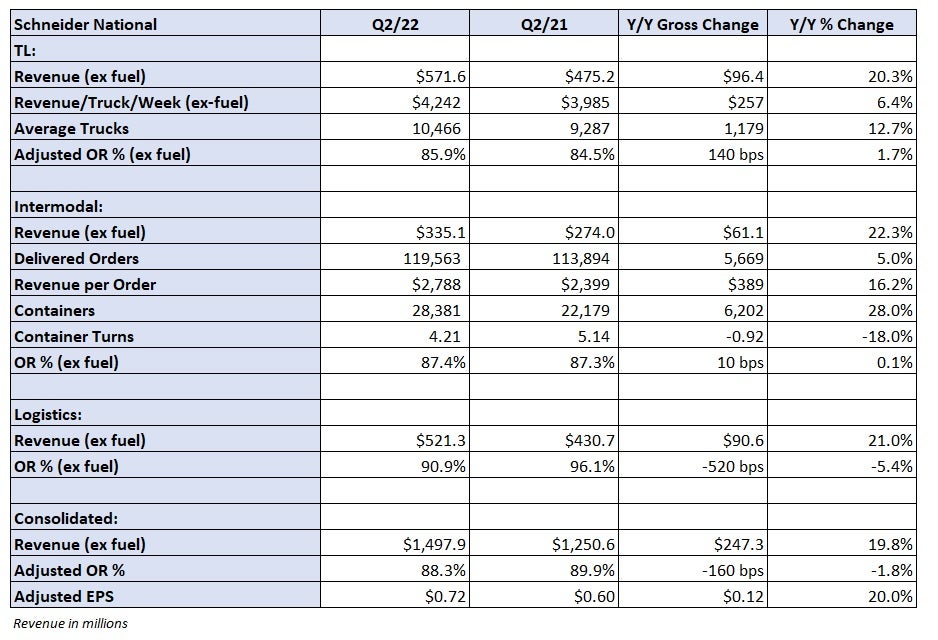

Schneider (NYSE: SNDR) reported slightly better-than-expected results for the second quarter. Adjusted earnings per share of 72 cents was 3 cents ahead of the consensus estimate and 12 cents higher year over year (y/y). The result was negatively impacted by 14 cents compared to the year-ago quarter. The company saw a 9-cent hit from valuation changes in equity investments and a 5-cent headwind from significantly lower gains on equipment sales.

Management upped the low end of its full-year 2022 EPS guidance by 5 cents to a range of $2.60 to $2.70. Part of the new assumption includes only $25 million in gains on sale in the back half as compared to the prior outlook, which called for $40 million.

Equipment delivery delays at the OEMs and the onboarding of new dedicated business has slowed the company’s trade cycle. Schneider only booked $2.8 million in disposal gains in the second quarter.

All of its segments — TL, intermodal and logistics — reported y/y revenue growth of roughly 20%.

The truckload division reported a 6% y/y increase in revenue per truck per week, with the average truck count increasing 13%. The dedicated fleet was up 1,848 units y/y, with roughly half of the increase coming from the $263 million acquisition of Midwest Logistics Systems at the end of 2021.

That deal was a way for Schneider to add capacity given the headwinds at the OEMs.

Not included in the number was the acquisition of deBoer Transportation in early June. The transaction added roughly 160 tractors and 660 trailers to the dedicated fleet and is expected to be accretive to earnings in the back half.

The TL unit reported an 85.9% operating ratio, 140 basis points worse y/y. Elevated driver costs, dedicated startup expenses and lower gains on sale were the primary detractors.

Management said it was mostly through with its annual contractual rate negotiations and that rate increases were sufficient to offset cost inflation.

Rourke told analysts on a Thursday conference call that capacity appears to be exiting the market quickly. He pointed to an increase in motor carrier authorities not being renewed. “The microcarrier has been the predominant growth vehicle for the industry, and I think that will be the first element of the industry that drops back off based upon inflationary pressures,” he added.

The intermodal segment saw orders increase 5% y/y with revenue per load up 16%. Congestion on the rails and delays at customer facilities resulted in container turns falling by 1x to 4.2x. The degradation in service, along with incremental startup costs, offset the growth in loads and yields. The division reported an 87.4% OR, which was 10 bps worse y/y.

The logistics unit benefited from the sweet spot of truck brokerage — still-elevated contractual rates and falling spot prices. The segment’s OR improved 520 bps to 90.9%.

More FreightWaves articles by Todd Maiden

- Forward Air CEO: ‘If there is a recession, bring it on’

- Large carriers still constructive on 2nd half

- Saia unlikely to alter growth plans on cycle’s downside