Shipment and freight spend data published by Cass Information Systems on Monday showed sequential improvement during August but the year-over-year (y/y) declines accelerated.

Volumes were up 0.8% seasonally adjusted from July but fell 10.6% y/y. The drop was 1.6 percentage points worse than the decline booked in July. Volumes captured by Cass didn’t turn negative until November last year.

| August 2023 | y/y | 2-year | m/m | m/m (SA) |

| Shipments | -10.6% | -7.4% | 1.9% | 0.8% |

| Expenditures | -25.0% | -9.7% | 1.1% | 1.8% |

| TL Linehaul Index | -11.5% | -5.0% | -0.5% | NM |

The update is worse than recent commentary provided by truckload carriers at an investor conference last week where some carriers said the market was becoming more balanced. At the event, multimodal transportation provider J.B. Hunt Transport Services (NASDAQ: JBHT) said its customers have rightsized inventories and that some expect volumes to increase in the back half of the year.

“Part of the large y/y decline is the comparison to the extraordinary time last summer when destocking was creating freight demand as retailers shipped out stale inventory,” ACT Research’s Tim Denoyer explained.

He also pointed to private fleet growth, which is pressuring volumes at for-hire carriers. Denoyer said the industry has been in a downcycle for 20 months, which is just shy of the average of 21 to 28 months experienced in the last three cycles.

Cass’ index is dominated by truckload freight, which accounts for more than half of total expenditures. Less-than-truckload, rail and parcel shipments account for the bulk of the remainder.

If typical seasonality holds, Cass’ shipments subindex will be flat sequentially in September but down 8% y/y.

Freight expenditures captured by Cass increased 1.8% seasonally adjusted from July to August but were down 25% y/y. The magnitude of the y/y decline was in line with the prior two months. The subindex faces a similar comp to 2022 in September but the comps step down in October and November before turning 4% negative in December.

The expenditures subindex captures the total amount spent on freight, including diesel fuel prices, which were 12% lower y/y in August. Accounting for the changes in shipments, actual freight rates were likely off 16% y/y in the month but up 1% sequentially (seasonally adjusted).

The 2023 forecast for the expenditures subindex remained unchanged at down 18% y/y. The subindex logged increases totaling more than 60% in the prior two years.

“Both freight volume and rates remain under pressure at this point in the cycle, but fuel price increases could limit the savings for shippers,” Denoyer said.

Diesel prices have jumped 20% since the beginning of July.

The forecast is for total expenditures to be 11% lower in the first half of 2024.

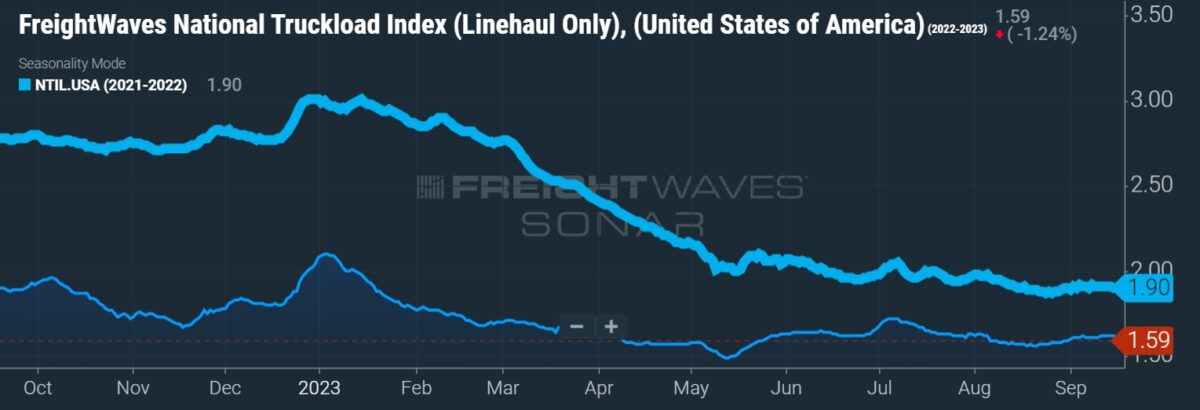

Cass’ truckload linehaul index, which excludes fuel surcharges and accessorial charges, fell 0.5% sequentially in August and was down 11.5% y/y. The magnitude of the y/y declines has continued to lessen since May.

“This likely reflects a combination of stabilizing spot rates and smaller declines in contract rates,” Denoyer said. “We’ve recently heard anecdotes of fleets addressing unacceptable rates, with some success remediating sharp rate declines. While not likely widespread, this suggests rates are nearing their lows.”

In addition to future consumer spending and the direction of the industrial and construction markets, truck capacity will be a key determinant of future rate changes. Management from Schneider National (NYSE: SNDR) said last week it is seeing signs that the market is tightening. It said driver availability has increased, its leasing business has seen an uptick in returned equipment and its brokerage segment has seen a decline in the number of carrier operating authorities being renewed.

“Though significant progress has been made in rebalancing, we think it’s unlikely that industry capacity will broadly tighten until pressure from private fleet growth eases, which seems possible in the next few months,” Denoyer said.

Data used in the Cass indexes is derived from freight bills paid by Cass (NASDAQ: CASS), a provider of payment management solutions. Cass processes $44 billion in freight payables annually on behalf of customers.

More FreightWaves articles by Todd Maiden

- Yellow asset sales, bankruptcy financing approved

- J.B. Hunt acquiring BNSF Logistics’ brokerage unit

- EFW doubles revenue with acquisition of Superior Brokerage Services