Recent trends show that U.S.-international trade is going south — to Mexico that is.

The ongoing trade war between the United States and China — and its resulting tariffs — have put Mexico on the map for nearshoring manufacturing operations. This, coupled with COVID-19-related disruptions hindering trans-Pacific trade, has led many to consider setting up shop closer to home.

Cross-border freight opportunities abound, as close to $2 billion in trade flows across the U.S.-Mexico border every day. But these rewards aren’t without risk.

Transportation providers are begrudgingly familiar with northern Mexico’s cargo theft and hijacking notoriety. Tangible risks like these are easy to conceptualize, but it’s intangible costs in the form of insurance coverage gaps that often snare unexpecting shippers. Those caught without cross-border and Mexican cargo insurance may end up on the hook for cargo lost or damaged south of the border.

Mark Vickers, executive vice president of international logistics at Reliance Partners, suggests that many shippers don’t realize the amount of risk that they’re taking upon themselves when moving freight into Mexico. What’s worse, some learn far too late that their cargo was inadequately covered.

Cross-border freight has traditionally been a complicated process. Vickers explained that securing insurance can become expensive as games of phone tag among the shipper, Mexican carriers and insurance agents drive up margins as more parties become involved.

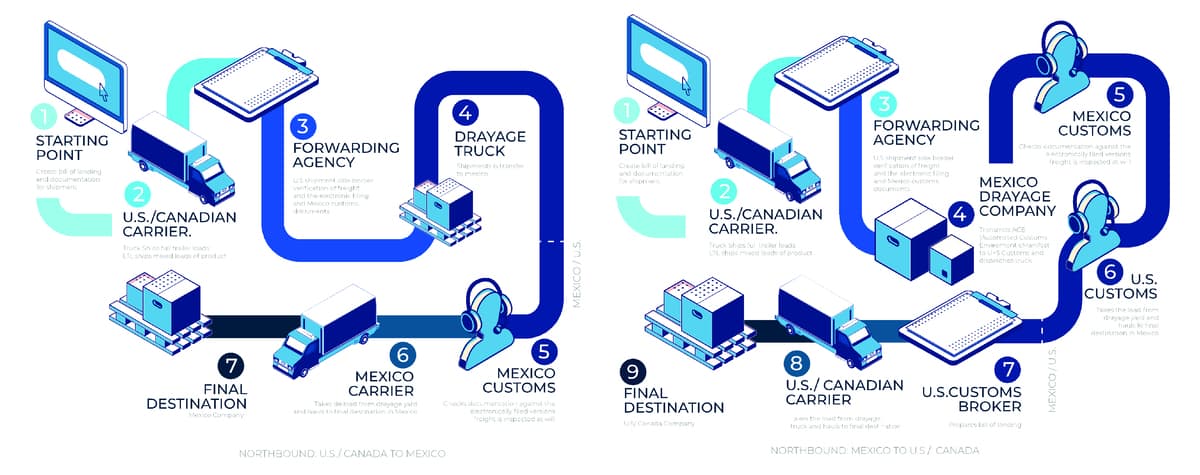

Image: Borderless Coverage presented by Reliance Partners

“By the time you get coverage that complies with the shipper’s requirements, you often still end up with high deductibles, and it probably doesn’t provide the level of coverage that you need,” Vickers said. “A lot of times it’ll only offer coverage in Mexico, although you really need primary cargo insurance from the moment of pickup in the United States until final delivery in Mexico because a lot of claims happen right at the border.”

In a previous interview with FreightWaves, Vickers noted that the majority of cross-border thefts and hijackings occur within a 100-mile radius of Nuevo Laredo in Mexico, just south of Laredo, Texas.

Vickers compares Mexico’s freight insurance requirements to the laws, or more appropriately the lawlessness, of the “Wild West.” U.S.-based motor carriers can be liable for up to $1 million in cargo loss, while Canadian-based carriers have a maximum liability of $2 per pound of freight.

In contrast, Mexico only requires carriers to be liable for just $0.025 for every pound transported.

He adds that shippers sometimes mistakenly believe that a carrier’s $100,000 cargo insurance policy extends across the border and that carriers will also be liable under Mexican law for lost or damaged cargo, but this often isn’t the case.

“In Mexico, it’s worse than the Wild West. What cargo owners don’t realize is that Mexican law only holds carriers liable for about 1 cent per pound of cargo, and it’s rarely enforced,” Vickers said. “That creates an enormous risk, especially considering the current rate of theft at the border.”

Reliance Partners’ Borderless Coverage offers automated, cross-border and Mexican cargo insurance to carriers, brokers and shippers full coverage from the moment of pickup until final delivery without any disruptions of coverage at the border. Coverage can be obtained on a per-load, project or annual basis, with broadest form and lowest deductibles available.

“Ninety-nine percent of carriers, brokers and shippers do not even know that they can get this type of coverage,” Vickers said. “They don’t understand that there’s a gap in coverage until a claim occurs.”

The benefit of cross-border coverage, Vickers said, is that it provides all-risk cargo insurance, paying only a fraction of the load value. This is a cost-effective alternative to relying on self-insurance, expensive armed vehicle escorts or other global cargo insurance policies with large deductibles — some upward of $20,000, he added. Borderless Coverage offers deductibles at around $1,000 or less and can cover shipments up to $5 million, according to Vickers.

Cross-border coverage eliminates questions on whether you’re covered regardless of what side of the border a claim occurs. Vickers stated that because 90% of Mexico-bound shipments are transloaded at the border, having a primary cargo insurance policy valid in both the United States and Mexico — in addition to anywhere internationally — gives peace of mind to all invested in the shipment.

“Cross-border and Mexico cargo insurance is a topic that everybody speaks about, but it’s hard to find a solution that really helps shippers, carriers and logistics companies, and most importantly, a solution that is clear in all aspects of coverage, deductibles, limits, etc.,” said Antonio Luna, managing director at Vitti Logistics. He said taking the friction out of the insurance process has increased customer satisfaction and allowed Vitti to secure more cross-border business.

“We experienced the same difficulties up until we attained Borderless Coverage,” Luna added. “The solution has helped us reduce cost and win new business — very straightforward and clear terms and conditions, easy to read and no small text.”

Mexico is currently the United States’ largest goods trading partner, with $614.5 billion exchanged between the countries in 2019. Vickers expects this trend to remain solid as he asserted cross-border trade is “skyrocketing” and reasons that now’s a good time for brokers and carriers to enter the cross-border freight market.

He pointed to a number of reasons for increased activity at the border, including recent nearshoring and manufacturing moves due to tariffs and COVID-19-related trade difficulties with China, the recent ratification of the United States-Mexico-Canada Agreement (USMCA) and the lack of tariffs between the U.S. and Mexico.

Logistics providers such as Sunset Transportation have found that offering cross-border solutions to its customers makes it easy to balance cost and coverage.

“Borderless Coverage has improved the fully integrated door-to-door solutions that we provide our international clients who come to Sunset Transportation to manage their cross-border and Mexican freight,” said Managing Director Jose Minarro.

“Now is a fantastic time to not only start your cross-border program but to really go full throttle,” said Vickers. “We work with a lot of 3PLs, brokers and carriers who offer cross-border transportation solutions. Those that are proactively offering cross-border insurance solutions are the ones winning the cross-border contracts. There’s no questioning that.”

Click for more FreightWaves content by Jack Glenn.

You may also like:

Don’t skate past safety precautions on icy roads

Beyond insurance, carrier vetting crucial to protecting freight brokers