More great news for ocean carriers like Zim is generally ominous news for U.S. importers paying painfully high freight bills — and there was a bounty of great news for Zim on Wednesday.

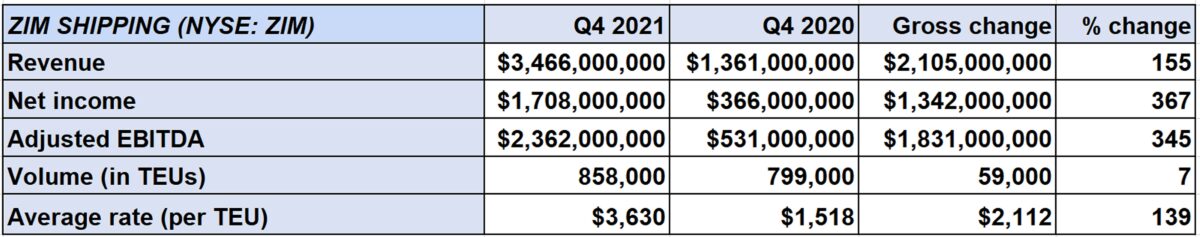

The shipping liner operator, which specializes in the trans-Pacific lane, posted net income of $1.71 billion for Q4 2021. Earnings per share were $14.17, handily beating the consensus forecast of $13.19. Net income for the year was $4.65 billion.

Full-year adjusted earnings before interest, taxes, depreciation and amortization came in at $6.6 billion, topping guidance for $6.2 billion-$6.4 billion.

What should worry U.S. importers even more is that Zim (NYSE: ZIM) expects this year to be even better.

Its just-released 2022 guidance, which is admittedly based on conservative assumptions, calls for adjusted EBITDA of $7.1 billion-$7.5 billion, up 8%-14% from 2021. That’s another billion on top of last year’s record-setting haul.

Jefferies analyst Randy Giveans projects even higher 2022 EBITDA for Zim: $7.77 billion. Giveans just raised his target price for the stock to $120 per share, from $100. The stock is currently trading at $75, five times its IPO price just over a year ago, and Zim has grown into by far the largest U.S.-listed shipping equity in any vessel sector, with a market cap of $8.9 billion.

Combining rate jump with more volume

Zim’s average freight rates jumped to $7,260 per forty-foot equivalent unit in Q4 2020, up 139% year on year and up 13% from the third quarter. Its full-year rate average came in at $5,572 per FEU, and the company predicts its 2022 average will be higher still.

Contract rates, which account for 50% of Zim’s trans-Pacific volume, should be up “significantly” this year, said CFO Xavier Destriau on Wednesday’s conference call.

Zim has strong visibility on first-half spot rates, which indexes show are around double rates in the first half of 2021. Even though Zim assumes spot rates will “start to gradually decline in the second half of 2022,” the average rate for the year, including spot and contract business, should end up higher than in 2021, explained Destriau.

What set Zim apart from many other carriers in 2021 was that it grew its top line via major increases in volume, not just rates.

Several carriers, including Maersk, opted to keep fleet size fairly steady in 2021; Maersk’s fleet capacity grew 2% last year. Others, such as MSC and Zim, opted for rapid growth. MSC expanded its fleet by 12%, according to Alphaliner, primarily by buying ships in the secondhand market. Zim increased capacity by 20%, primarily by chartering ships.

Congestion constraint

Carriers’ volumes were constrained last year by port congestion, which left a portion of their fleets stuck idle offshore. By rapidly growing their fleets, carriers like MSC and Zim were able to more than offset congestion downside and heavily boost volumes.

Congestion did hit Zim’s numbers toward the end of the year, as predicted, causing Q4 volumes to slip 3% versus Q3. But even so, its full-year volumes rose 22.5%, whereas Maersk, which didn’t significantly expand its fleet, saw volumes rise just 0.2%.

Zim predicts its volume growth will be much lower this year, at 6%-7%. Its newbuilds don’t arrive until 2023-24, and charter and secondhand markets are now extremely tight and extremely expensive, limiting the ability of any carrier to rapidly expand.

The port congestion factor

Port congestion ties up fleet capacity, but it’s still a net positive for carriers because the negative effect on volume is more than offset by the boost to freight rates.

Port congestion is a double negative for cargo shippers: It hikes costs and increases transit time.

Zim executives expect congestion to persist through this year and possibly into 2023-24. Destriau sees “no sign” of an end to the supply chain squeeze.

Flexport’s Ocean Timeliness Index (OTI) measures the time it takes cargo to get from an Asian factory to the gate at a North American port. Last week, the trans-Pacific eastbound OTI was at 106 days, down from a peak of 114 days in late January but still exceptionally high.

Project44 measures delays between ports of lading and discharge on various routes. Its data shows that delays between Shanghai and Los Angeles in February were the second highest ever, averaging 10.3 days for the month, with delays between Shanghai and New York the highest ever at 14.5 days.

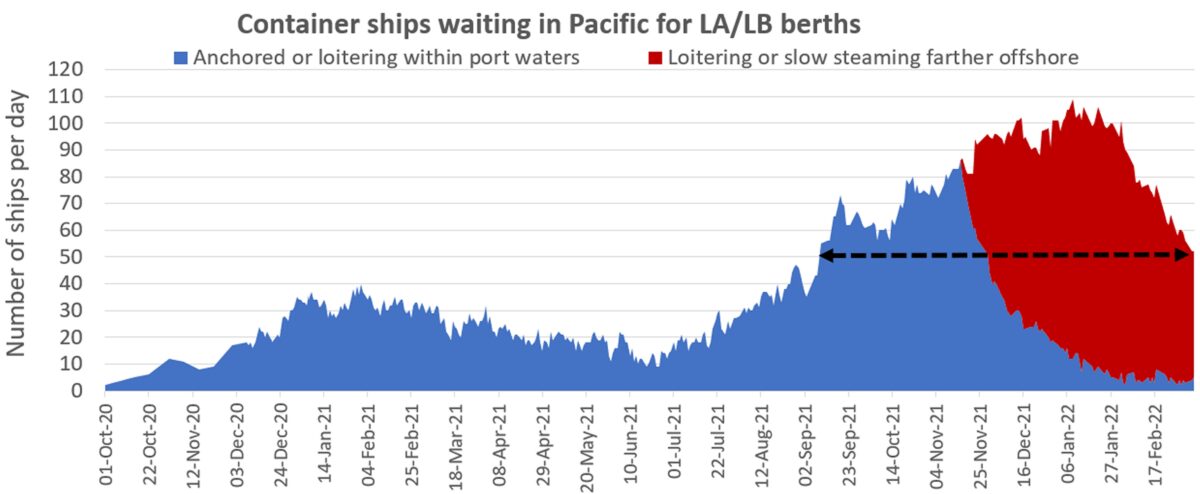

Declining queue

One of the most closely watched congestion indicators is the number of container ships waiting to berth in the ports of Los Angeles and Long Beach. Unlike other bellwethers, it has been signaling a significant reduction in congestion.

There were 50 container ships waiting as of Wednesday, according to data from the Marine Exchange of Southern California. That’s less than half of the all-time high of 109 on Jan. 9, and the lowest level since early September.

Asked about the sharp decline in the California queue, Destriau said it could be a result of lower seasonal exports around the Lunar New Year holiday, which may have allowed terminals to clear some of the backlog. He also said it could be a result of congestion shifting to other terminals, such as those in Vancouver, Canada, and along the U.S. East Coast.

Zim CEO Eli Glickman sounded uncertain and skeptical when discussing the declining number of ships waiting to berth in Los Angeles/Long Beach.

“We really don’t know what the situation is,” he said of the queue numbers, adding that Zim is still seeing pressure in the trans-Pacific trade lane. “I cannot assure you that we have a new trend for LA,” he told analysts.

Click for more articles by Greg Miller

Related articles:

- How invasion of Ukraine could ease shipping logjam off US ports

- Supply chain whack-a-mole: West Coast eases, East Coast worsens

- New wave of contracts will lock in much higher shipping rates

- Glimmer of hope: Has the ship gridlock off ports finally peaked?

- Shipping giant Maersk could rake in $50 billion over just two years