Freight pundits have spent plenty of time over the last few months wondering when conditions would improve. In the first quarter, despite that initial glimmer of hope in the beginning, capacity remained too high for demand. That pushed rates further downward and contributing to big-ticket acquisition and bankruptcy news within trucking. It did not help to boost freight sentiment.

Now Q2 has begun without much evidence of a substantial uptick on the horizon. As earnings stream in from major transportation providers, these headwinds are now on full display. Management for J.B. Hunt, one of the main bellwethers for freight transportation, tempered expectations for the rest of the year and referred to current conditions as a freight recession.

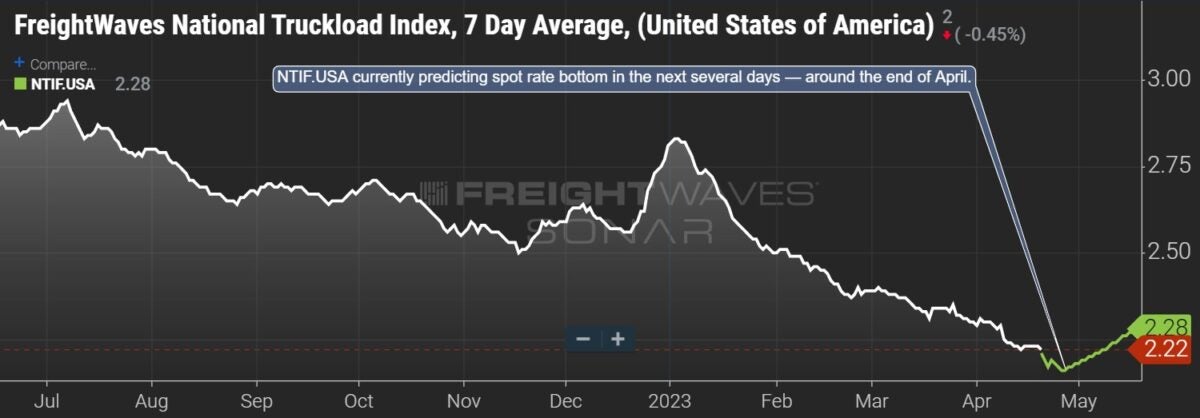

In truth, it takes little time to find new anecdotes on social media about how absurdly low truckload rates have gotten. Meanwhile, maritime imports remain sluggish, which means foreign goods won’t be saving domestic volume. Shippers are now enjoying the most pricing power they’ve had in years.

We might now be at the bottom of the freight market, and this is how it feels, according to the Q2 Freight Sentiment Indexes.

The indexes, which are derived from surveys of carriers, brokers and shippers, measure near-term and longer-term profitability, workforce and business investment sentiment. For the first time since we started tracking sentiment in Q4 2022, an overall score has fallen into the negative.

Carrier sentiment: Praying for the nadir

It’s a big deal for the overall carrier score to be negative (minus 0.52), even in conditions like these. That’s because longer-term metrics like profitability a year from now are weighted the same as near-term profitability. Naturally, most respondents default to thinking next year’s second quarter will be more profitable than the current.

This means that for an overall score to land negative, near-term sentiment must almost always be very bad, in relative terms. And for carriers right now, it is.

Sector respondents scored near-term profitability minus 11.22, meaning they expect Q2 to be less profitable than Q1. It’s the third straight quarter they’ve expected to be less profitable compared to the previous quarter. They scored near-term workforce minus 4.26, which indicates carriers expect to end the quarter with fewer people on the payroll.

From a wider lens, this could be an early indication of capacity beginning to leave the market in earnest. That would start to apply upward pressure on rates.

Watch: Have we hit the bottom?

Carriers do continue to feel positive about their expectations 12 months down the road. But longer-term profitability (6.28) and workforce (4) were dampened relative to Q1, meaning they’re now less certain about early 2024 than they were last quarter. That trend mirrors the guidance given so far by executives at public trucking companies in their Q2 earnings calls.

Business investment sentiment — a gauge of how welcoming or unwelcoming the current environment is for new technology investments — dropped to 2.60 from 8.69. This means carriers are less likely to solicit third-party vendors for services that improve operational efficiencies.

Broker sentiment: Looking for an opening

At first glance, it doesn’t make much sense to see overall sentiment improve for brokers in Q2. The likeliest explanation is that when we were surveying for Q1, data was suggesting the freight market might be stabilizing, which tends to yield a more challenging environment for brokers. Instead, truckload spot rates continued to drop.

The Transportation Intermediaries Association (TIA) published a white paper in February about the damages of fraudulent double brokering. That white paper worked to raise the visibility of those voicing concerns about the practice, alleging that the issue could be costing brokers upward of half a billion dollars annually.

RELATED: TIA’s stark message: Double brokering, fraud out of control

When perpetrated fraudulently, double brokering often works like this: A broker selects what it thinks is a carrier, sometimes with a name that’s similar to a large, well-known carrier, to complete a load. That carrier uses a quick-pay service, which takes a small amount from the payment, and then reposts the load at a wildly inflated price that other carriers jump at. The fake carrier gets its quick-pay cash but doesn’t pay the carrier it dumped the load to (and which actually delivered the load). The double-brokering “carrier” then disappears, and while the initial broker isn’t technically on the hook for the double payment, it will often pay so as to not damage the relationship with the shipper.

The end of March also saw the Federal Motor Carrier Safety Administration siding with the interests of small-business carriers rather than freight brokerages. On March 23, the FMCSA announced the initiation of a formal rulemaking process proposed by the Owner-Operator Independent Drivers Association and the Small Business in Transportation Coalition (SBTC). The next day, it announced it had denied a petition from the TIA to remove a requirement that brokers disclose to carriers the transaction records between brokers and shippers.

At issue, as laid out in the OOIDA and SBTC petitions, is whether a provision requiring that a driver or other counterparty to a broker-managed transaction be able to obtain and review deal documentation from the broker — which is the current law [49 CFR 371.3(c)] — can be turned into a rule that the counterparties must get that documentation if requested. FMCSA noted that SBTC explained in its petition how freight rates at the time had “dropped drastically and that motor carriers have reported instances of brokers engaging in ‘profiteering, price gouging and low-balling tactics.’”

Regardless, overall broker sentiment came in at 9.39, up 2.42 points from Q1. This was driven by near-term profitability sentiment that’s now positive — up 5.11 points, to positive 0.19 — and longer-term profitability sentiment, which climbed 5.38 points to 16.88.

The only category that didn’t improve for brokers was business investment. It declined 3.25 points to 11.52. When averaging the three segments (carriers, brokers, shippers), overall business investment sentiment has declined in each of the last two quarters. That’s as far back as our young indexes go.

Shipper sentiment: Holding power (cautiously)

This isn’t exactly a comfortable market for anyone. Shippers do have leverage on the transportation pricing side, but that doesn’t mean they’re hunky-dory. The economy features a wide variety of unknowns. We don’t know when the Federal Reserve will stop raising the effective federal funds rate.

If economies are like motor vehicles, central banks are transmissions. And in the case of the U.S. economy, the Fed is definitely downshifting. The trouble is that it’s hard to gauge the rate at which it should be slowing or, more importantly, the rate at which it actually is slowing.

For shippers, the fate of 2023 lies mostly in the hands of consumers. In our Q2 outlook survey, 71% of shippers said consumer goods demand would be a primary driver of trucking capacity in the second half of this year. That was 20% more than the next most commonly picked driver: inflation. Of course, continued resiliency from consumers depends on them keeping their jobs and on inflation continuing to decline.

Unfortunately, we see increasing evidence from indicators like U.S. box-makers that current demand and future volume expectations are muted for the rest of the year. Packaging Corp. of America, the third-largest box-maker in North America, reported in its Q1 results that shipments of corrugated products had seen the steepest quarterly decline since the Great Financial Crisis.

More than half of shippers say their current inventory levels are higher than target, and they ranked that as their most challenging concern in Q2. While this group continues to be the most positive segment of the three, sentiment eroded in four out of five categories quarter over quarter. The one category that bucked that trend was near-term profitability, which climbed to 11.26 from 5.39 in Q2.

Related articles