The highlights from Tuesday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market Watch for Nov. 8:

Atlanta

Volumes in Atlanta are picking up steam after dropping to their lowest levels since April 2020.

Outbound demand from the Empire of the South took a major tumble, falling 8.4% from Oct. 30 until Sunday. This week, however, things are finally beginning to pick back up.

The Outbound Tender Volume Index for Atlanta edged upward nearly 9 points, or 2.1%, to 426.53. That’s a modest increase for a market such as Atlanta, but industry professionals working out of the region are already feeling the impact.

“Atlanta’s outbound volumes moving along the East Coast are looking great,” said Preston Pickett, a logistics manager at Steam Logistics. “Capacity is readily available and rates are dropping.”

The increase in volume is moving rejection rates upward. The Outbound Tender Reject Index is up 38 basis points this week to 3.5% and still pointed in an upward trajectory, indicating that there is more than enough available capacity to handle the increase in volume.

Elizabeth, New Jersey

Rejections and truckload volumes in Elizabeth, New Jersey, are in a stalemate as imports to the Port of New York and New Jersey decline.

The seven-day moving average for U.S. customs maritime import shipments to the Port of New York/New Jersey began to trickle down on Oct. 27, dropping 11.6% from that time until last Wednesday. Imports then took a steep drop, falling another 28% from Wednesday to Friday.

The surface transportation industry immediately saw the drop in imports, evident by the Outbound Tender Volume Index in Elizabeth plunging more than 44 bps, or 14.2%, to 266.43 on Thursday.

Since then, truckload volumes remain flat. The Outbound Tender Volume Index is only up 1.5 bps in the last four days, and rejections are following a similar trend.

The Outbound Tender Reject Index for Elizabeth ticked upward 32 bps on Wednesday to 4% and since then has moved slightly downward to 3.9%. The lack of movement in the last week indicates that carriers are settling into their contracted freight in order to secure loads during the unvarying volume levels.

NTI as a point of reference

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.

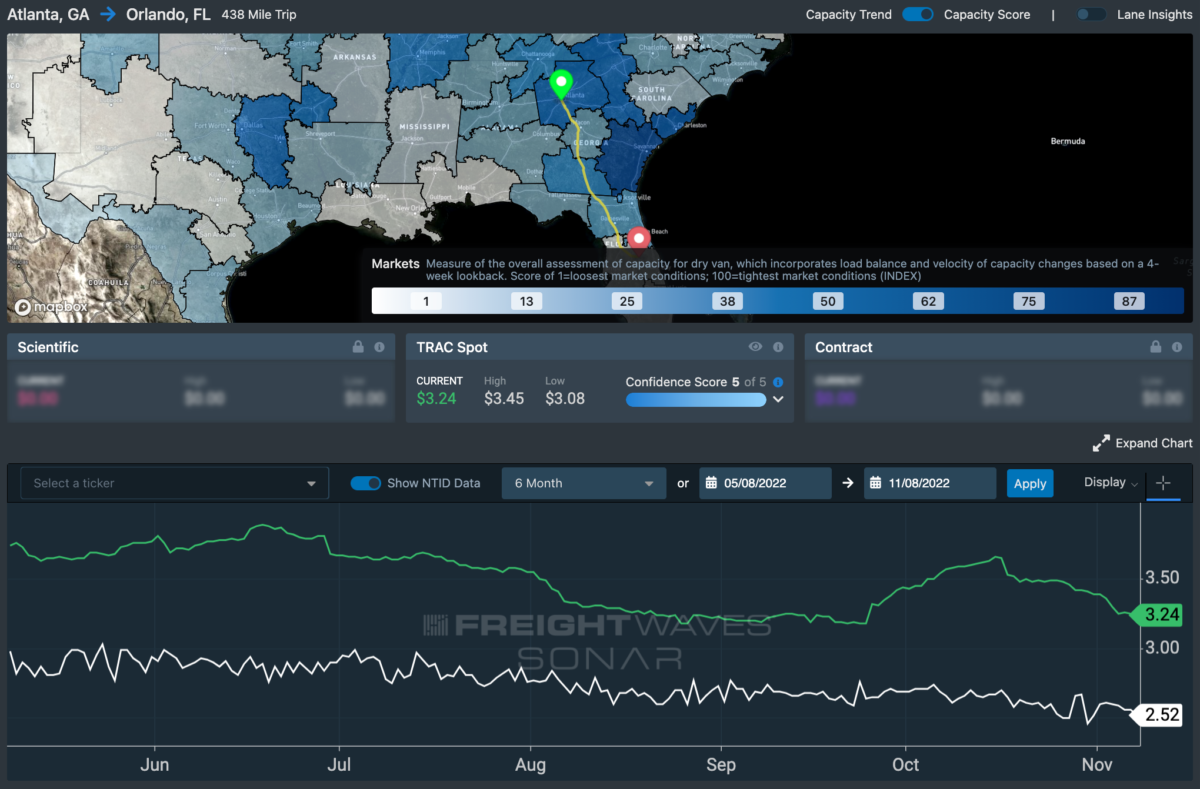

Lane to watch: Atlanta to Orlando, Florida

Spot market rates from Atlanta to Orlando, Florida, are down 15 cents since the start of the month but still remain elevated at $3.24 a mile — 72 cents above the national average.

However, the downside is that outbound volumes from Lakeland, Florida — which is the market Orlando falls under — are seeing a relatively repressed amount of growth, rising only 1.7% since Friday.

The better option would be to deadhead to the Jacksonville, Florida, market. Jacksonville has seen a 9.1% increase in outbound volume in the last week and is still trending upward, presenting a better chance to book a load out of Florida.