The highlights from Thursday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market watch

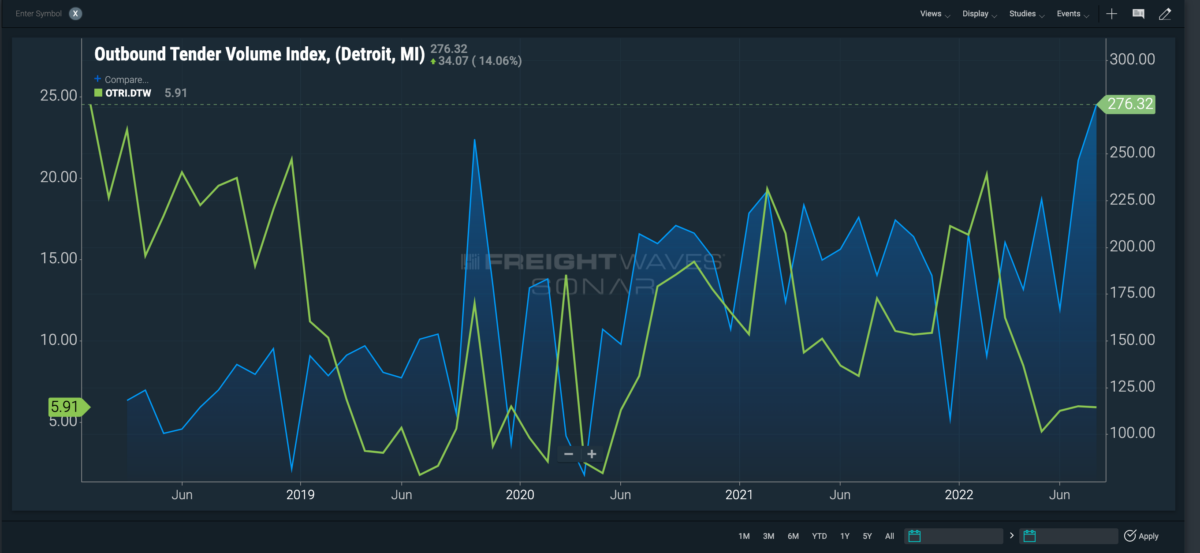

Detroit

Outbound volumes in the Motor City are roaring back to life. In fact, outbound tender volumes are at the highest level on record since FreightWaves SONAR began tracking the market in 2018.

Since July 20, outbound tender volumes for Detroit have risen 18%, while inbound loads climbed 17.7%. The steady increase in both brings Detroit’s Headhaul Index up to minus-25.7, which is still a backhaul market.

Outbound load volumes might be at historic highs in Detroit, but trucking capacity is still loose. Outbound tender rejections dropped 92 basis points since the run in volumes began July 21 to 5.9% — their lowest level since the start of the pandemic.

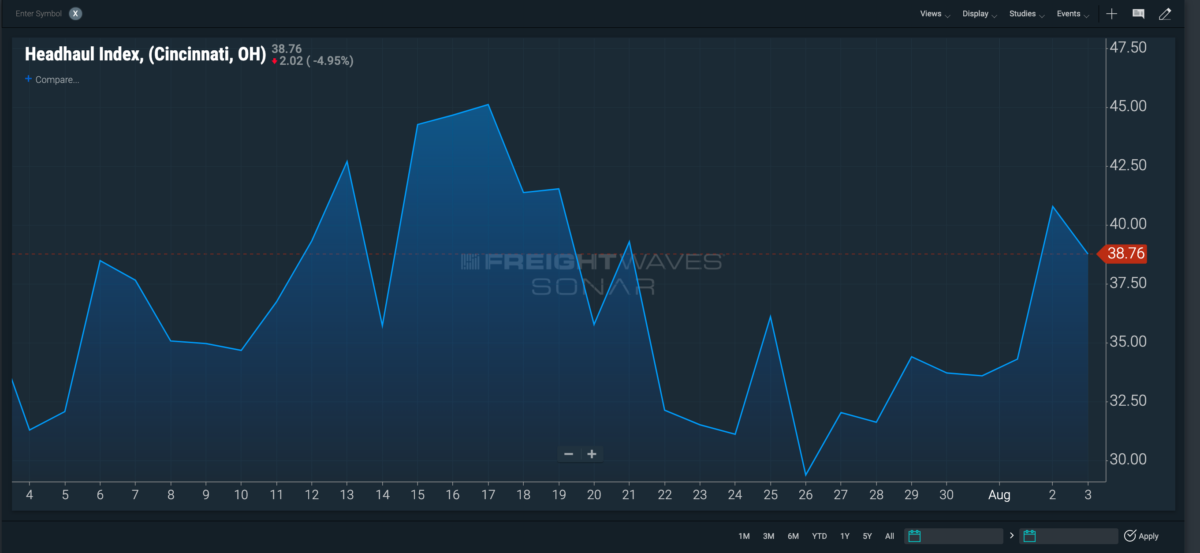

Cincinnati

Cincinnati’s outbound volumes have mounted a 10.8% increase in the past week, while inbound freight volumes remained consistent. The climb in outbound tenders has prompted a 6.7% week-over-week (w/w) increase in the Headhaul Index, bringing it to plus-38.7.

The growth in outbound volumes have pushed rejections rates upward roughly 300 bps to 7.2%, 100 bps above the national average of 6.2%.

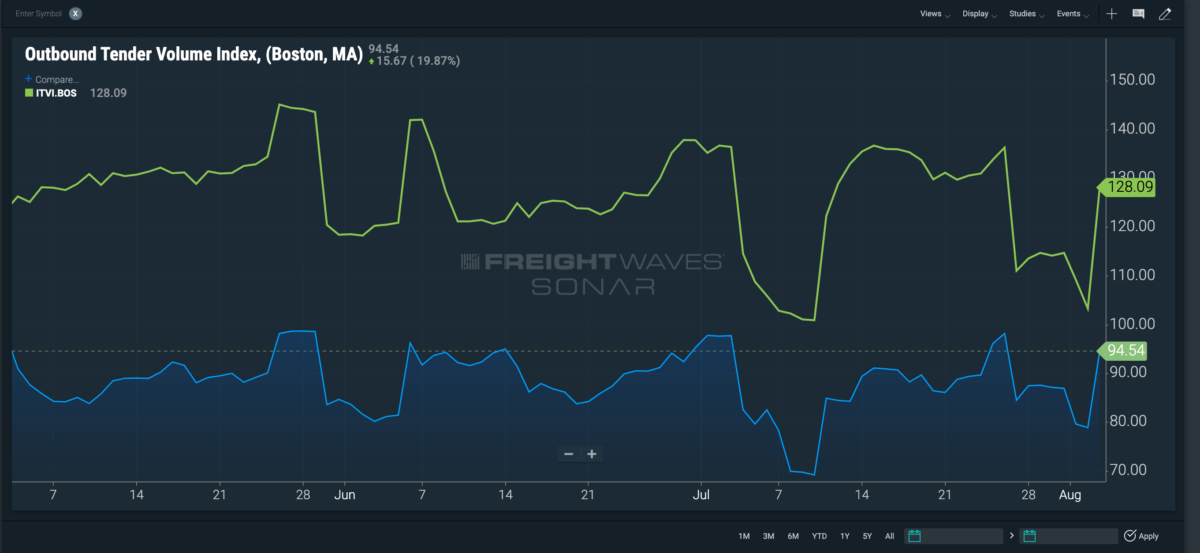

Boston

Along with record-high temperatures, inbound and outbound volumes in Boston are heating up. Inbound loads have boomed 24.5% overnight, and outbound volumes increased right behind them 19.8% in the last 24 hours as well.

In recent weeks, the Headhaul Index has been rising. But now with the majority of freight traffic entering the market instead of leaving, it has created a significant decline, pushing it back down to minus-33.5.

Outbound tender rejection rates have remained relatively steady at 2.8%, well below the national outbound tender rejection rate of 6.25%.

NTI as a point of reference

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.

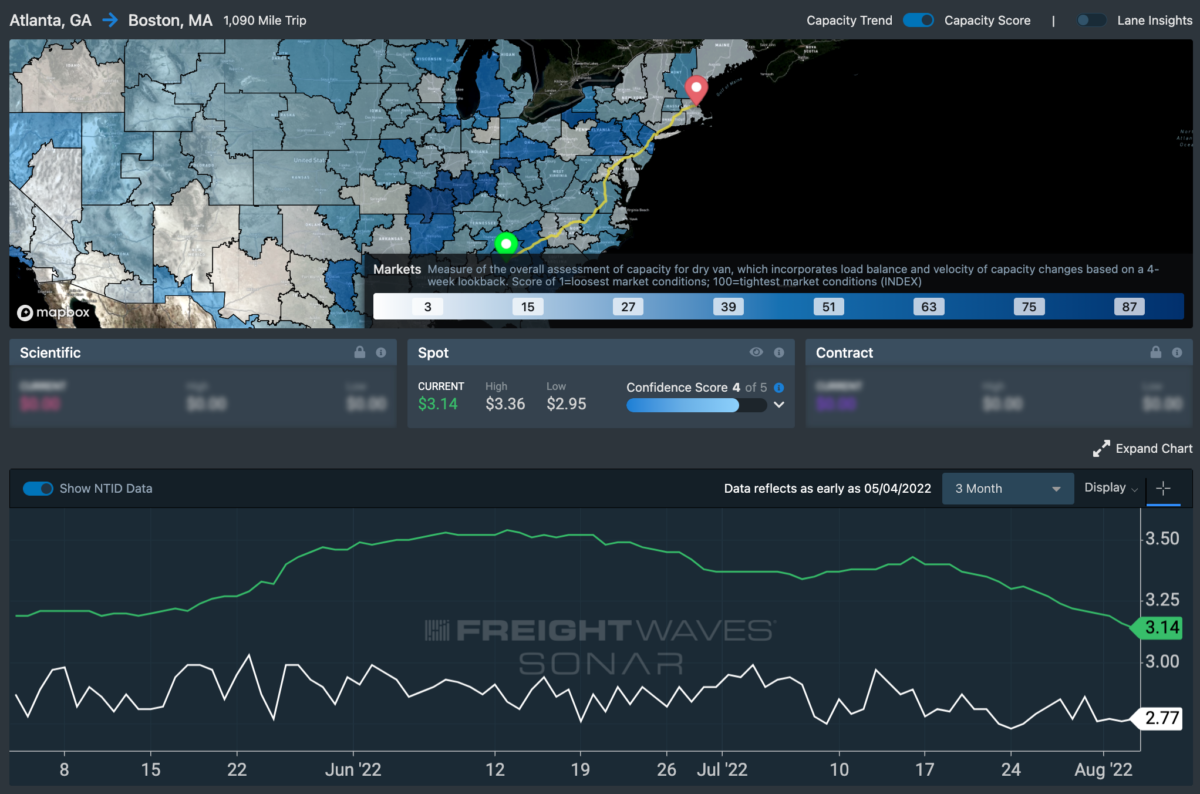

Lane to watch: Atlanta to Boston

Spot market rates in this lane may have fallen 29 cents in the last couple of weeks of July, but they still remain 37 cents higher than the national average. To sweeten the deal, the current rise in outbound volume from Boston presents good odds for booking a load coming out.