The highlights from Tuesday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Lane to watch: Dallas to Chicago

Overview: Rejections are likely to increase further with the Headhaul Index up 13% w/w.

Highlights:

- Dallas outbound tender volumes are up 2% w/w, signaling that demand for capacity is increasing slightly w/w.

- The Headhaul Index in Dallas is up 13% w/w, signaling that capacity is likely to tighten further in the coming days as outbound demand outpaces inbound volumes.

- Dallas outbound tender rejections are already up 259 bps w/w but are likely to climb even higher in the coming days due to the growing volume imbalance in Dallas.

What does this mean for you?

Brokers: The w/w change of 13% in the Headhaul Index is a large shift in the Dallas market prior to the Christmas holiday. With outbound tender rejections already up 259 bps w/w, this increase in the Headhaul Index is signaling that capacity in Dallas is likely to tighten even further in the days ahead. Expect significant upward pressure on spot rates this week and for capacity to be especially tight.

Carriers: Dallas pricing power is likely to shift even further in your favor in the coming days and weeks. Keep an eye on outbound tender rejections, and if they continue to shift higher w/w, then you are likely to see significant upward pressure on spot rates prior to the holiday weekend.

Shippers: Your shipper cohorts in Dallas are still averaging just over 3 days in tender lead times, but history indicates that when capacity tightens quickly in Dallas, lead times should be between 3.5 and 4 days to help relieve some of the pressure being put on capacity and spot rates.

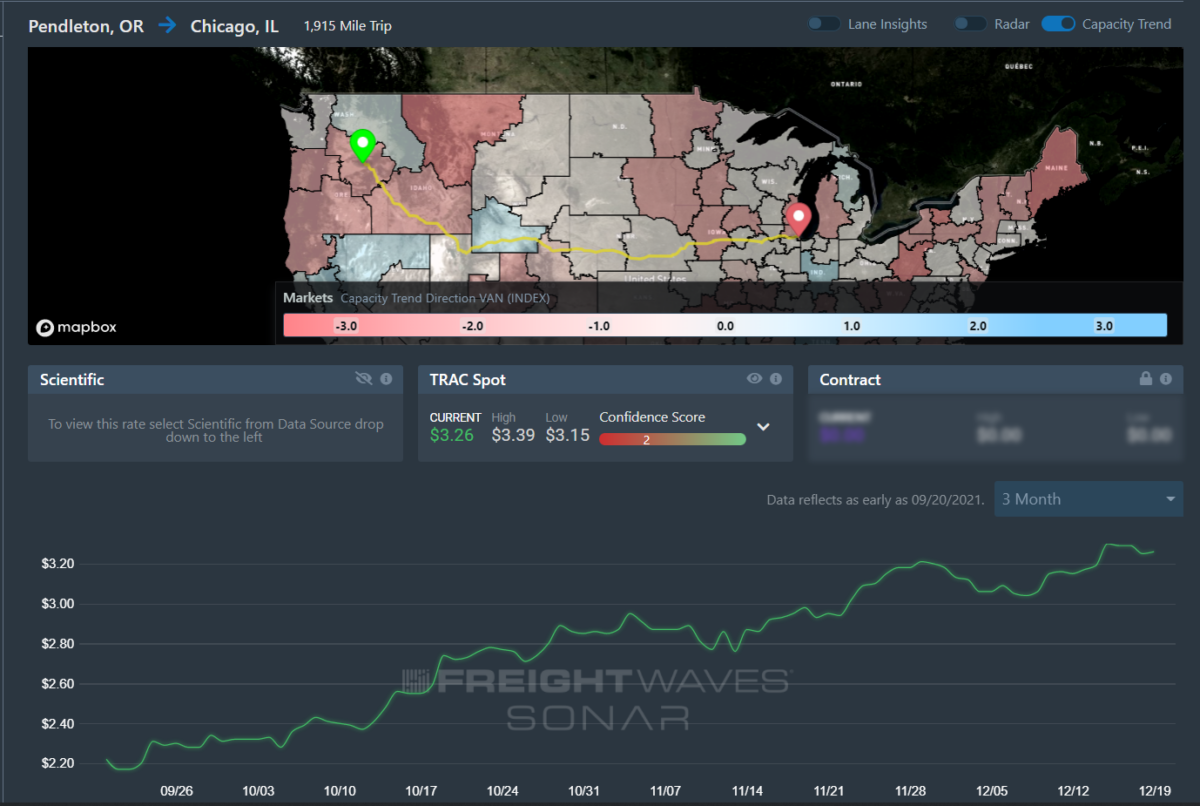

Lane to watch: Pendleton (Ore.) to Chicago

Overview: Reefer rejection rates have averaged above 60% out of Pendleton this fall.

Highlights:

- Average spot rates for reefer loads moving in this lane have been above $3.20 over the past week.

- Reefer rejection rates out of the Pendleton market have averaged over 63% since Oct. 1 and are currently over 64%.

- Chicago’s outbound rejection rate for reefer loads has increased from 29.5% to 33.5% over the past week.

What does this mean for you?

Brokers: Expect the most challenging outbound capacity conditions of the year in this lane. Consider yourself extremely fortunate on any loads moving under $3.15 per mile. Chicago is currently tightening as well, which should make it a favorable destination for most carriers.

Carriers: If you are operating over the next few weeks, the Northwest is a solid region to find outbound freight with high margin potential. This lane should prove profitable at origin and destination as reload potential is on the rise out of the Chicago market.

Shippers: Secure any capacity you can if you need to move freight in this lane. Spot rates for reefer loads are not easing in this area and most contract rates have become irrelevant. Typically there is some easing by this point, but that has not materialized yet.

Watch: Loaded and Rolling’s first episode

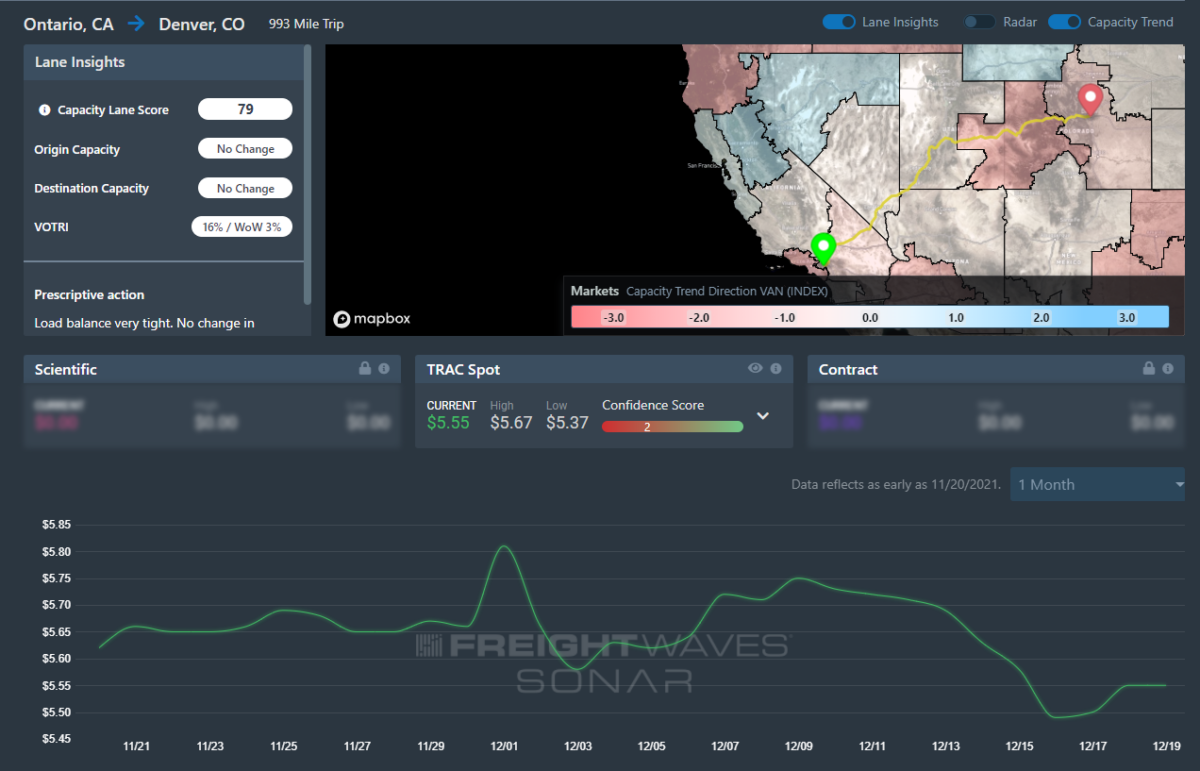

Lane to watch: Ontario (Calif.) to Denver

Overview: Capacity is tightening faster than most of the country relative to respective market size.

Highlights:

- Both Ontario and Denver are tightening faster than most of the country relative to the size of the respective markets. Rejections in Ontario are up 184 basis points (bps) week-over-week (w/w) and rejections are up 582 bps in Denver.

- Outbound volumes from Ontario are holding up better than national volume levels, down just 0.3% w/w compared to -3.46% on a national level.

- FreightWaves TRAC rates have been around the $3.65/mi range for the past month, but have fallen in recent weeks as rejection rates fell post-Thanksgiving.

What does this mean for you?

Brokers: Focus on outbound Southern California loads early, as rejection rates rise and securing necessary capacity becomes more tiresome and more expensive. Pad margins early in the week as spot market activity should increase in the coming days.

Carriers: Try to push rates higher out of Southern California, especially as drivers start to come off the road for the holidays. Accept loads into Denver, where getting higher paying loads outbound should be easier due to rejection rates rising rapidly in the market.

Shippers: Push lead times out in order to secure necessary capacity during the holiday week. Lead times currently sit at 2.5 days in Southern California, so pushing them out to nearly 3 days may make securing capacity slightly easier as carrier networks are disrupted.

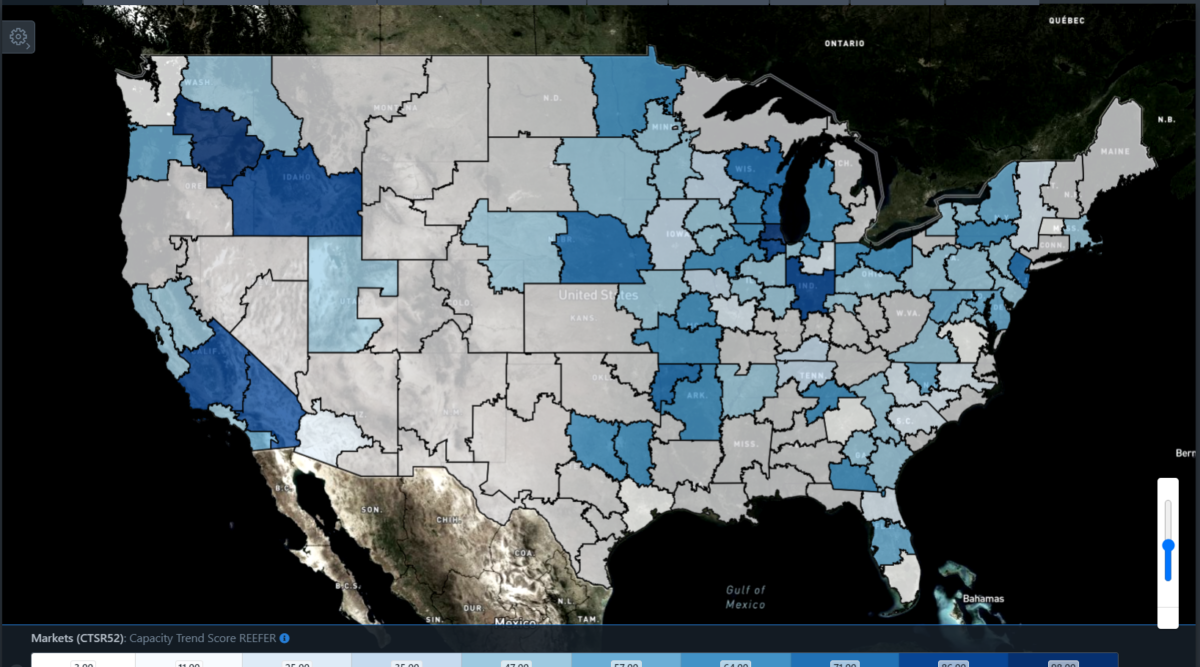

Focus on … Capacity Trend Score Reefer

The Capacity Trend Score for refrigerated capacity shows the Pacific Northwest continues to struggle as tender rejection rates are among the highest in the country out of the Pendleton market.

Reefer outbound tender rejection rates had settled below 40% for most of the summer but spent most of the fall above 60%.

Seasonality certainly plays a role, but weather has played a major role in disrupting normal patterns over the past year; extreme conditions have impacted harvest yields and disrupted transportation patterns.

The capacity trend scores combine outbound and inbound load volume balance with tender rejection rate information to help users get a more complete picture of capacity conditions in the 135 U.S. markets.