The highlights from Tuesday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

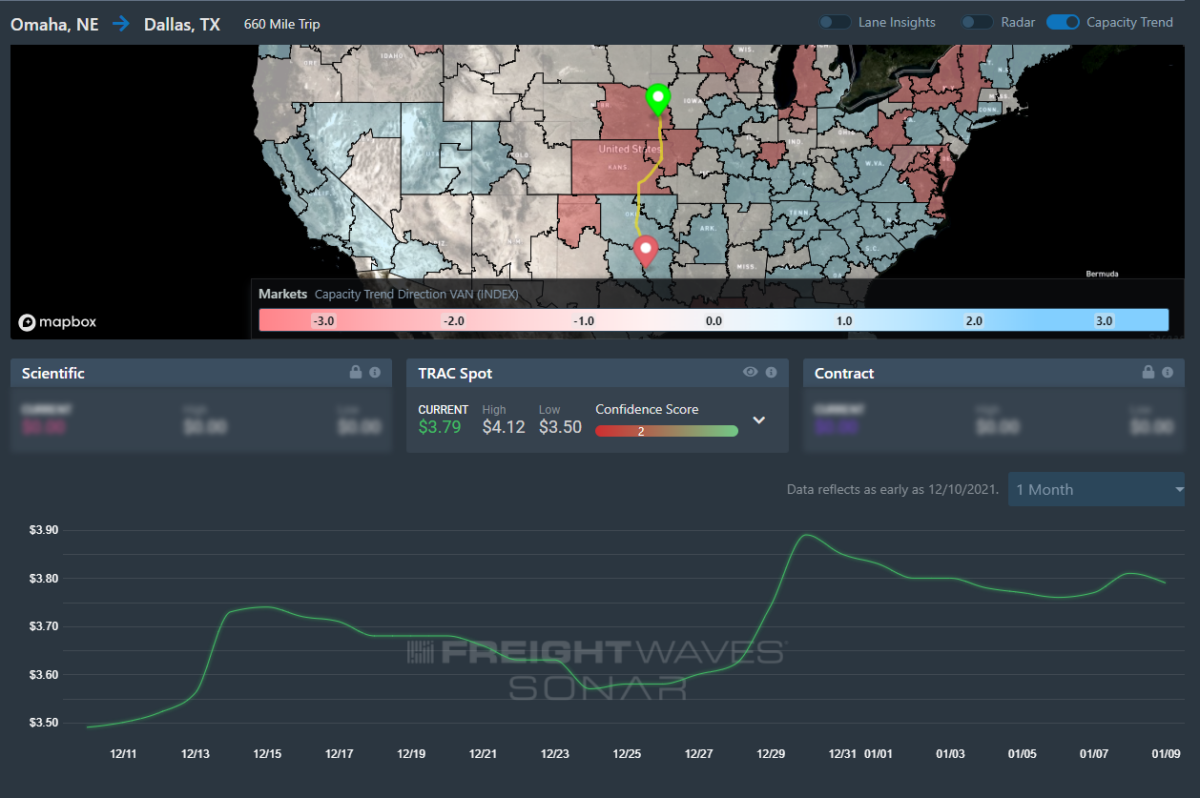

Lane to watch: Omaha (Neb.) to Dallas

Overview: Rejection rates are still holding strong in the Midwest.

Highlights:

- Omaha’s tender rejection index has jumped 7% in the last week, markedly higher than it started at the beginning of the year.

- The increase in outbound rejection rates does not suggest any significant decline in spot rates or volumes.

- Dallas outbound rejection rates have dropped from 19% to 16.5% since the beginning of the year (-3% over last week).

What does this mean for you?

Brokers: Spot rates for this lane have declined since the end of the year but are still inflated compared to a month ago. Rates will be higher coming out of Omaha; pad rates or add lead time to the shipment.

Carriers: The tight market in Omaha has led to increased rates; increase offerings accordingly. Look to the spot market if you need a load out of this market.

Shippers: Be aware you may have to increase your lead time in this market to ensure your load is covered at a fair rate. Double check with carriers for backhaul opportunities to avoid having to pay inflated spot market rates.

Watch: Carrier Update

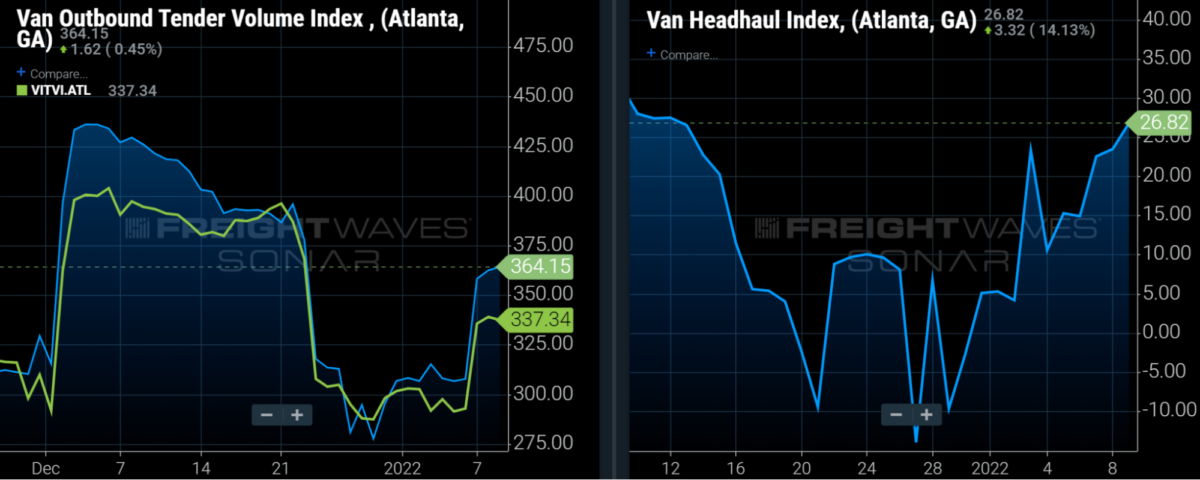

Lane to watch: Chicago to Atlanta

Overview: Atlanta becomes a more favorable destination for carriers as outbound demand for dry van capacity outpaces inbound demand.

Highlights:

- The current average dry van spot rate that brokers are paying for on-demand capacity is $4.10/mile, including fuel surcharges, up from $4.02/mile at the beginning of the year.

- The domestic intermodal spot rate is $3.73/mile, including fuel surcharges, 9% below the latest dry van spot rate.

- The average daily domestic intermodal volume in the lane in the past week is 214 containers/day, compared to 275 before the holidays.

What does this mean for you?

Brokers: Even though the tender rejection rate in the lane has moderated since the holidays, you may want to raise your rates slightly in order to preserve margins given the recent increase in rates that other brokers are paying for purchased transportation. When bidding for capacity, keep in mind that other brokers are paying an average of $4.10/mile in the lane with $4.40/mile and $3.82/mile representing rates in the 67th and 33rd percentiles, respectively.

Carriers: Some carriers may be reluctant to head to Atlanta because its outbound dry van tender rejection rate of 15.4% is well below the 20.1% national rate. But, carriers should also keep in mind that the rising Atlanta Van Headhaul Index (which increased from -10 in late December to 27 currently) suggests that it should be easy to get reloaded in Atlanta. The increase in the Headhaul Index also indicates the market is tightening.

Shippers: The current spread between intermodal and dry van spot rates may not be enough to entice shippers to utilize rail intermodal, particularly because the latest intermodal volume in the lane suggests that intermodal networks are not running as fluidly as is optimal. For shippers using the highway, keep lead times extended to at least the 2.7-day average to help secure capacity.

Watch: How shippers can minimize risk with tight OTR capacity

Lane to watch: Atlanta to Harrisburg (Pa.)

Overview: Rejection rates heading into the Northeast remain well above the market average.

Highlights:

- Atlanta’s outbound rejection rates have fallen back from their holiday levels to just above 16%.

- Lane rejection rates to Harrisburg remain among the highest out of the market, but have also declined from their peak values. Spot rates have also stopped increasing in this lane.

- Harrisburg’s outbound rejection rate has dropped from 23.7% to 22.2% since the start of the year.

What does this mean for you?

Brokers: Expect rates to stop climbing as capacity is easing out of the Atlanta market. Keep loads moving into the Northeast a priority out of Atlanta as contract compliance remains low.

Carriers: Do not expect as much spot market activity out of Atlanta this week because rejection rates are on the decline. Loads moving into the Northeast will provide the highest margins if you are confident in reloading out of the Harrisburg area.

Shippers: Keep lead times high for loads moving in this lane, but compliance in general should be improving out of Atlanta. Expect this lane to be slightly easier to cover in the coming weeks.

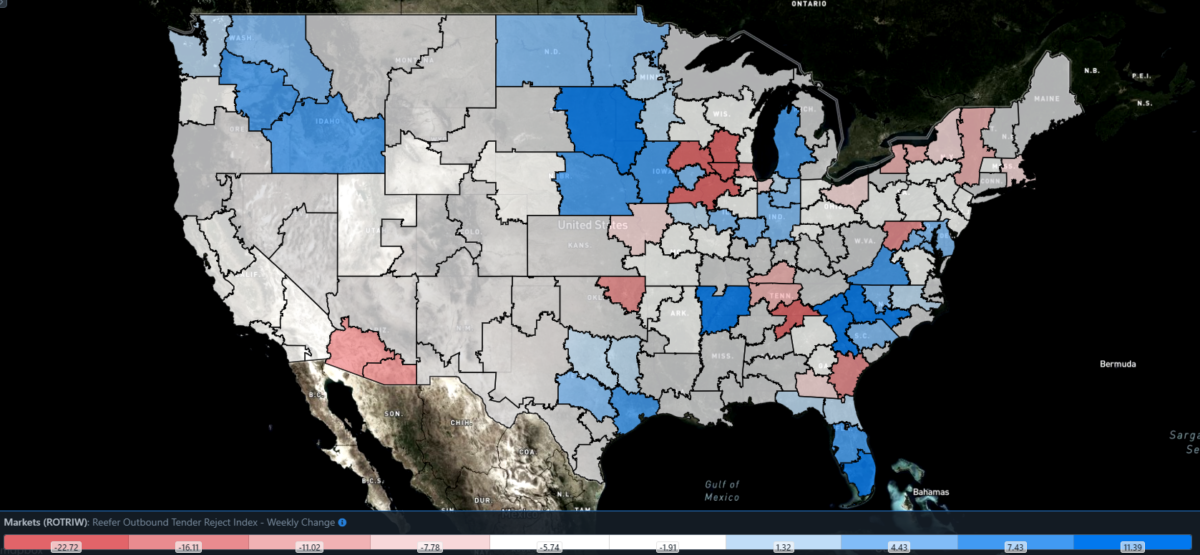

Focus on … Reefer Outbound Tender Reject Index

Reefer rejection rates briefly rose above the 40% mark last week for the first time since last May.

The ability to secure reefer capacity over the past year has been troublesome at many points but staying on top of capacity changes can ease some of that pressure.

The Reefer Outbound Tender Reject Index – Weekly Change (ROTRIW) signals those markets that are experiencing the largest changes in capacity, with markets that are blue experiencing upticks in rejections and red markets experiencing a decrease in rejection rates.

Two markets in South Florida — Lakeland and Miami — experienced dramatic increases over the last week, placing upward pressure on reefer spot rates.