The highlights from Wednesday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Lane to watch: Columbus (Ohio) to Elizabeth (N.J.)

Overview: Rejection rates are higher out of Columbus.

Highlights:

- Columbus’ outbound rejection rate has climbed back over 19.6% after bottoming around 18.1% last week.

- Rejection rates to Elizabeth also edged higher to 18.06% after hitting 17.5% last week, though they have fallen below the overall market average. Spot rates have stopped falling and are currently hovering around $4.81 per mile.

- Elizabeth’s outbound rejection rate has jumped over 2 percentage points over the past two weeks, hitting the highest point since late January.

What does this mean for you?

Brokers: Do not expect continued easing in this lane this week. Pad margins by a few cents where you are uncertain of coverage. Continue to keep this lane as a top priority for finding daily coverage. Take any rate below $4.80 per mile.

Carriers: Accept more loads in this lane. Elizabeth’s capacity continues to tighten and should offer increasing reload potential with high margins. Look to the spot market if you need to find an Elizabeth inbound load out of Columbus.

Shippers: Double-check with your carriers on all loads moving in this lane over the next week to stay on top of any potential disruptions to service. Prioritize all inbound loads to the Northeast because they are currently some of the most difficult to cover.

Watch: Shipper Update

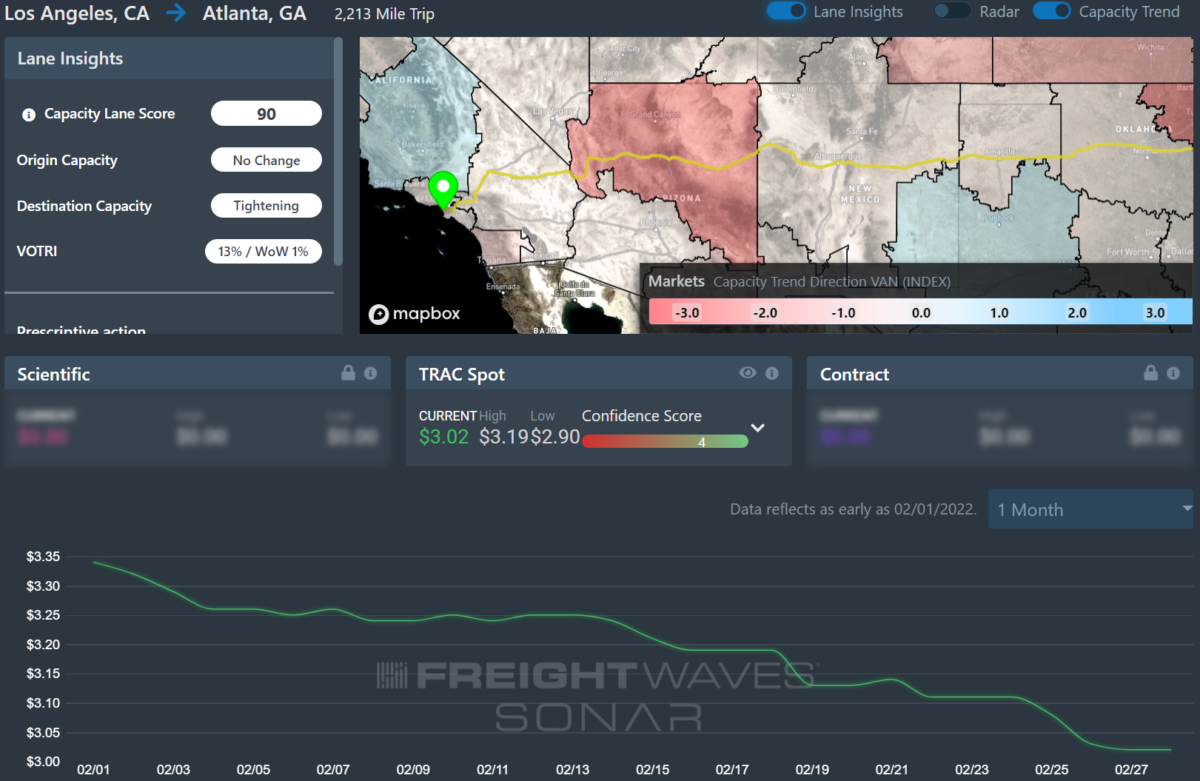

Lane to watch: Los Angeles to Atlanta

Overview: Dry van spot rates have fallen 10% in the past month.

Highlights:

- The door-to-door domestic intermodal spot rate declined 27% in the past two weeks to $2.50/mile, including fuel. That is 17% below the average dry van spot rate of $3.02/mile, including fuel, as shown in the Market Dashboard app.

- The dry van spot rate of $3.02/mile is 10% lower than it was one month ago.

- Dry van carriers are rejecting 12.7% of tenders in the lane, which is above the 9.7% tender rejection rate for all long-haul (>800 miles) outbound LA loads, which suggests that some carriers are reluctant to head to Atlanta.

What does this mean for you?

Brokers: Lower your bids to reflect the declining spot rates that other brokers are paying for dry van capacity in the lane. When negotiating with carriers, stress that it should be easy to get reloaded in Atlanta given its current status as a headhaul market.

Carriers: The four-day trip will put you in the Atlanta market, which could be thought of as a mixed bag. The Atlanta dry van outbound tender rejection rate of 14.3% is 410 basis points (bps) below the national average, but Atlanta remains a headhaul market given its Van Headhaul Index of 32.

Shippers: Rates in the lane suggest that spot shippers may be able to use domestic intermodal in the lane for a financial advantage, which is a departure from the trend during most of the last year. For shipments that are more time-sensitive, keep highway lead times extended past the 2.8-day average for inbound Atlanta loads.

Watch: Carrier Update

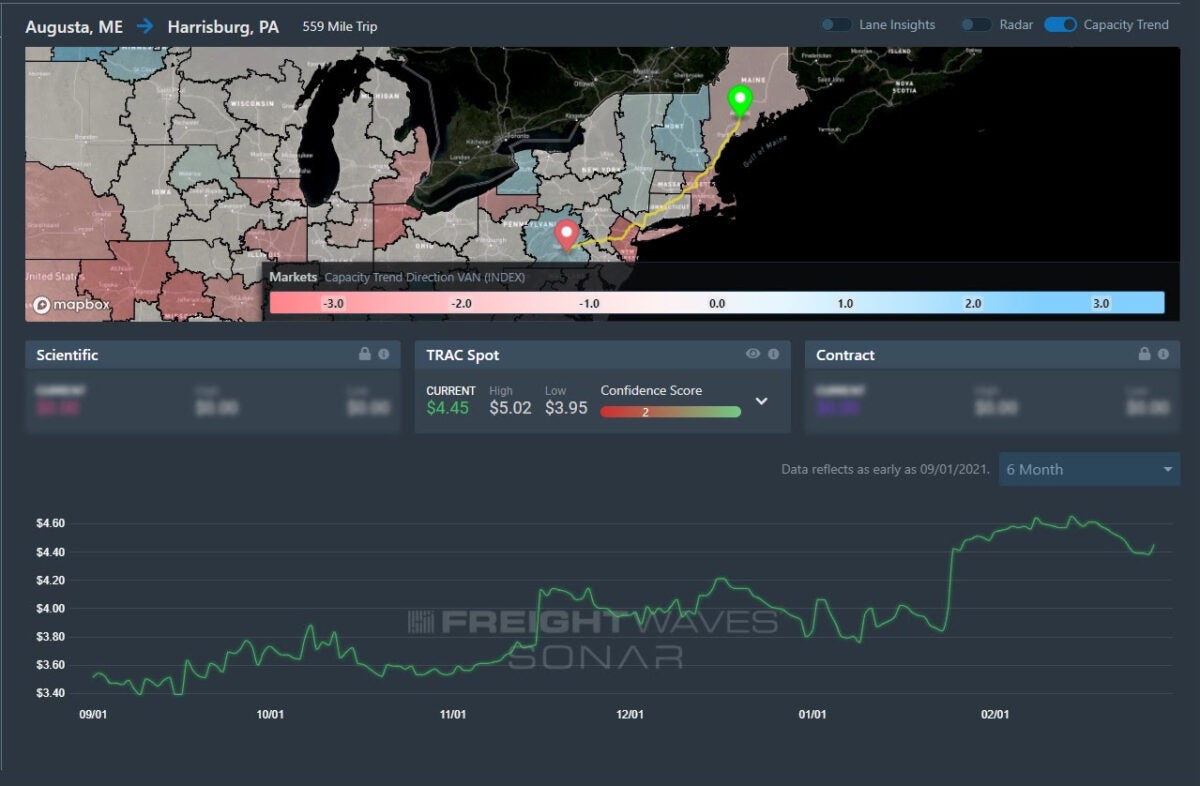

Lane to watch: Augusta (Maine) to Harrisburg (Pa.)

Overview: Spot rates remain high following multiple winter weather events.

Highlights:

- FreightWaves TRAC spot rates remain high at $4.45 per mile following multiple winter storms that impacted the area near the end of January.

- Outbound tender rejections remain high at 20.66% compared to the overall Augusta market rejection rate of 11.83%.

- For context, outbound tender rejections in the greater Augusta market drastically plummeted from around 65% at the beginning of February down to 11.83%, indicating the market is normalizing after multiple winter storms disrupted transportation in the region.

What does this mean for you?

Brokers: While outbound tender rejections fell to 11%, intra-Northeast rejections continue to hover around 15% to 20% for the Harrisburg, Allentown and Philadelphia areas, indicating capacity remains tight for intra-Northeast freight. Focus on driving down rates for outbound Maine loads greater than 600 miles, as the market appears to be normalizing with slight downward movements in spot rates.

Carriers: Weather conditions appear to be improving as spring approaches, but spot rates remain dictated by limited carrier capacity. The sharp decline in overall outbound market tender declines will place a greater focus on service and tender compliance. However, intra-Northeast lanes continue to remain high and present opportunities for greater revenue if ad hoc quotes become available.

Shippers: The good news is tender compliance for most out-of-region Maine freight has improved to only 11% but continue to expect capacity issues with regional loads with shorter length of haul. Focus on greater tender compliance for out-of-region loads. The arrival of spring should bring greater capacity into the market as road and weather conditions improve, which should drive down outbound rates.