The highlights from Monday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

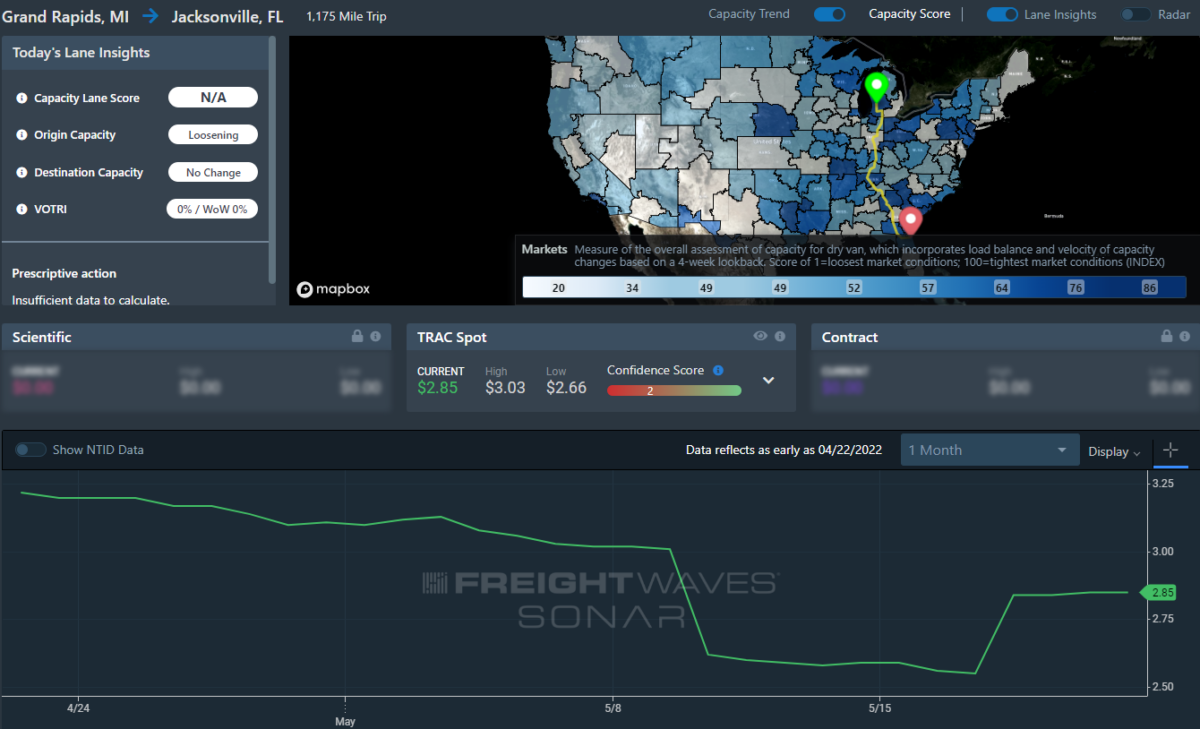

Lane to watch: Grand Rapids, Michigan, to Jacksonville, Florida

Overview: Grand Rapids to Jacksonville rates have crept up ahead of the holiday weekend.

Highlights:

- Grand Rapids outbound tender volumes increased 10 basis points (bps) from last week and do not seem like they will trend downward anytime soon as we head into the holiday weekend.

- Late last week the spot rate for this lane shot up about 30 cents per mile, to $2.85 a mile. That is not enough to break the bank but more of a rebalance from the plummet a few weeks ago.

- Jacksonville’s outbound tender volume is up 33 bps from last week.

What does this mean for you?

Brokers: Capacity is loosening in Grand Rapids but rates are continuing to crawl upward. An all-in rate around $3,351 should get a carrier on that load with few issues. Watch this lane closely as it gets closer to the holiday weekend; capacity could get tighter.

Carriers: Capacity is loosening in Grand Rapids, making it less than ideal to end up in that market. Hold firm on rates as the holiday weekend gets closer. The end of the month will put pressure on shippers to try and push out more volume. Leverage those existing relationships to get shipments that benefit overall business.

Shippers: The end of the month is coming and it’s a holiday weekend as well, making for a crunch to meet monthly volumes. Anything that needs to be shipped, should be shipped out now with a minimum of three days lead time to ensure capacity can be met as the holiday weekend comes closer.

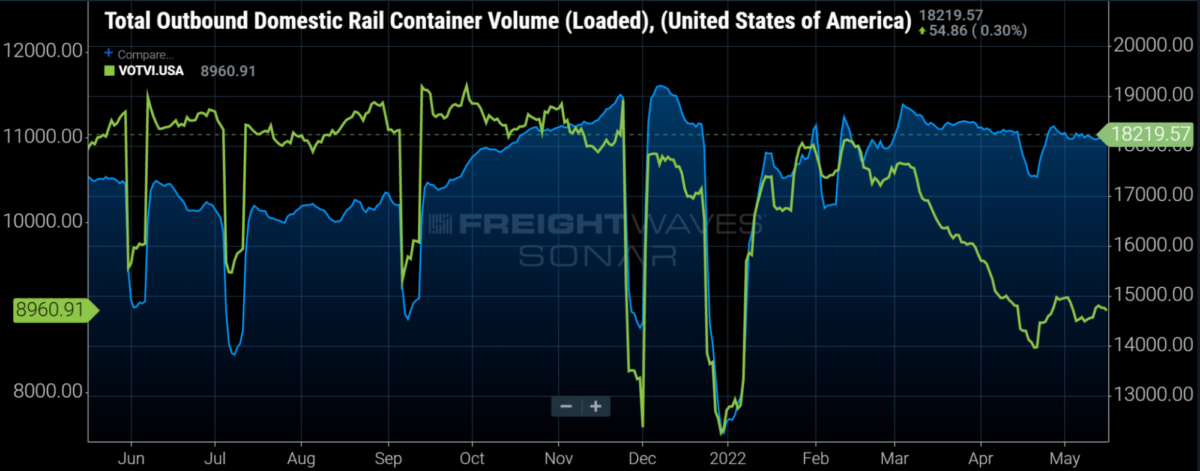

Looking only at domestic intermodal volumes, one would not see much evidence of a freight recession. Domestic intermodal volume was higher by 6.8% year-over-year (y/y) in the first quarter and domestic intermodal volume continues to outpace year-ago levels. In the second week of May, domestic intermodal volume increased 5% y/y. Domestic intermodal has outperformed both international intermodal (which was down double digits y/y in the first quarter) and domestic truckload tender volume (shown in the green line in the chart above), which has fallen sharply since early February.

Part of the reason for that is the high inventory levels for nonedible items and high warehousing costs, which have encouraged use of intermodal, the slower mode. The high inventory levels are a result of retailers pulling forward imported goods shipments and also consumers pulling back on discretionary expenditures. At the end of their fiscal first quarters, inventory levels at Walmart and Target were 33% and 44% above their year-ago levels. Commentary on sales by those to mega-retailers illustrates that consumers have pulled back on hard lines (durable goods such as furniture, appliances and electronics) and other general merchandise. Intuitively, consumers have less to spend after paying for higher-priced food and gasoline. As a result, the strong domestic intermodal volumes may be short-lived as retailers place smaller orders for imported consumer goods.

Watch: Carrier update

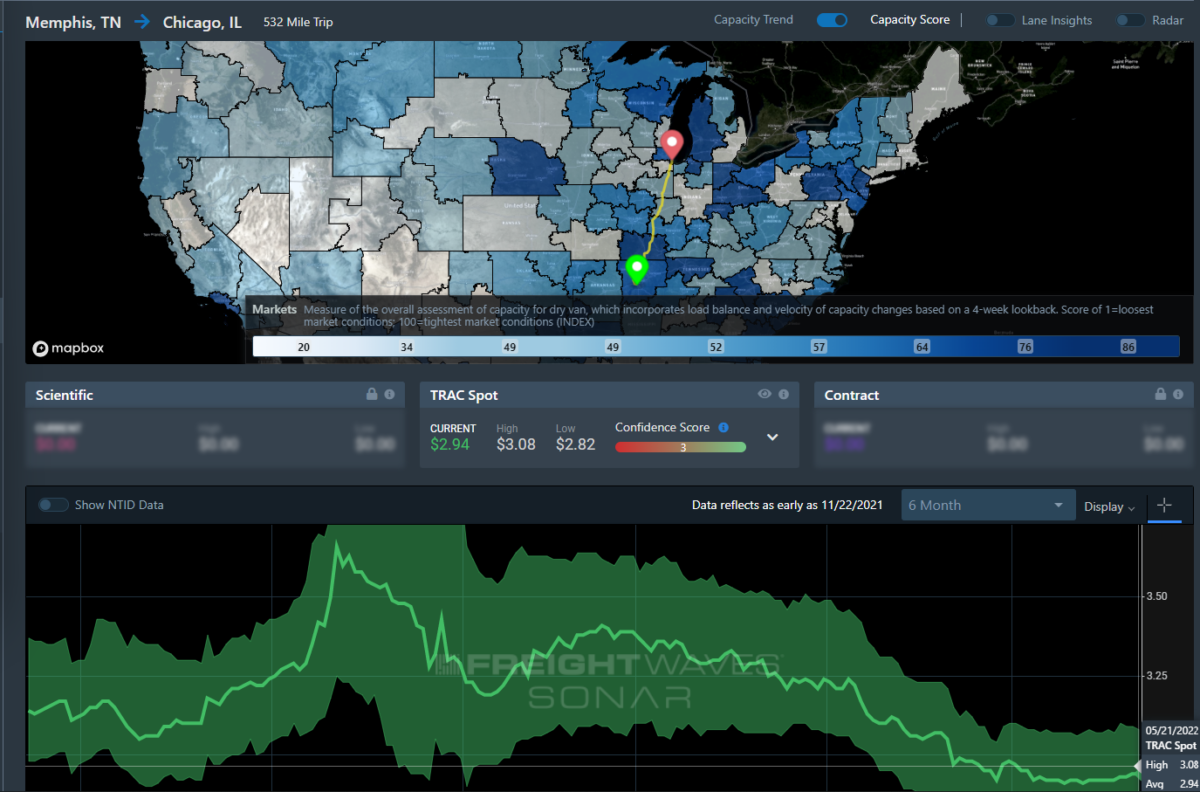

Lane to watch: Memphis, Tennessee, to Chicago

Overview: Memphis rejection rates plummet, contradicting the market.

Highlights:

- Spot rates have moved only slightly higher over the past few days, increasing less than a percent over last week. The increase is more than likely due to Memorial Day approaching.

- Memphis’ outbound rejection rate has dropped over three percentage points over the past week — from 9.75% to 6.7%.

- Chicago tender volumes and rejection rates have both stabilized after hitting a floor earlier in the month.

What does this mean for you?

Brokers: Target all-in rates right around $1,550 including fuel. Rejection rates are falling, indicating Memphis may not be as influenced by the upcoming holiday. It may be worth your time to shop.

Carriers: Spot rates are not increasing significantly in this lane. Do not get greedy or waste your time pushing premiums for standard service loads. Expect conditions in Chicago to remain consistent for reload potential.

Shippers: Make sure your carriers are giving you better than 90% compliance in this lane. If they aren’t, then make sure your rates are not too far below the market value (around $2.90 per mile including fuel).