The highlights from Thursday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

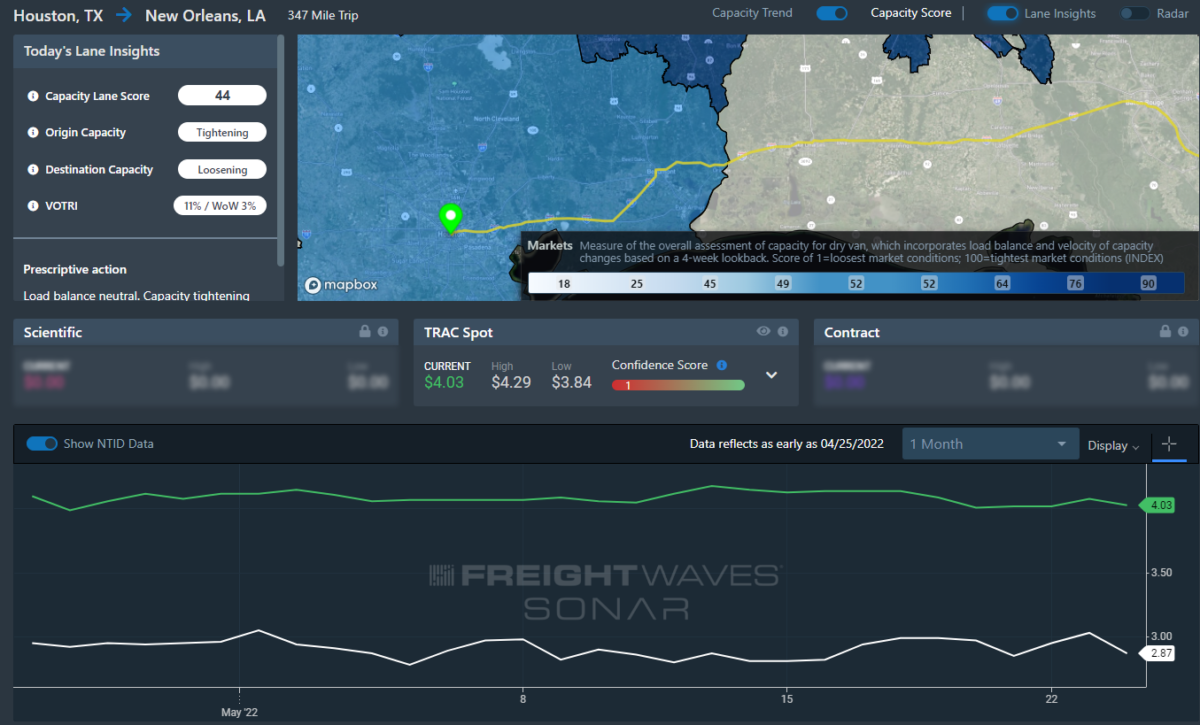

Lane to watch: Houston to New Orleans

Overview: Spot rates in this lane are almost almost double the national average.

Highlights:

- Outbound tender volumes are falling but are still at the second-highest volumes of the month.

- Spot rates are at $4.03 for this lane, some of the highest rates among the nation’s major lanes.

- New Orleans outbound tender volumes are becoming more unpredictable as it climbs to 19.78%, which is double the national average.

What does this mean for you?

Brokers: Capacity is tightening in Houston, meaning rates should be trending upward. While the rate for this lane is holding steady, the New Orleans market is putting downward pressure on the spot rates, making for an odd balance of consistent rates.

Carriers: Capacity is tightening in Houston; combined with high outbound tender volumes that makes an ideal market to send some extra trucks. The rates are higher out of Houston than other parts of the country, making it doubly worthwhile.

Shippers: Outbound tender lead times are hovering around 3.5 days. With rejections in Houston nearly double the national average, adhering to those outbound tender lead times will be crucial to avoid overpaying for freight. With market tightness back in the picture, it’s important to tender early to guarantee coverage.

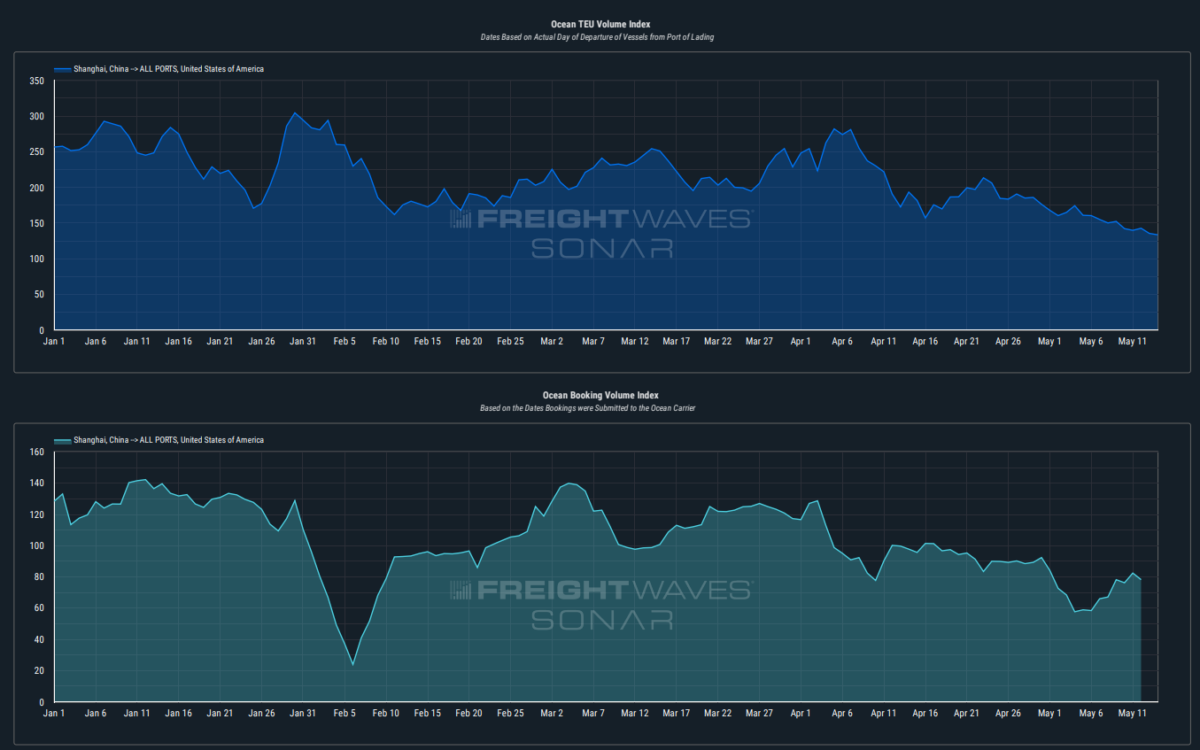

For the week ahead, we will be looking for more insight into what’s happening in China. The plan is for reopening in Shanghai to begin Wednesday. We will see how it is actually progressing as it becomes more clear in our data. Since the announcement about Shanghai, authorities in China have also alerted the public that they are going to start a more aggressive testing regimen in Tianjin that could potentially result in lockdowns for the major top 10 export port that exists there (normally referred to as Tianjin/Xingang). What seemed like a promising reopening for Shanghai could still be disrupted between now and Wednesday, or it could be replaced with lockdowns in other major port cities. Ocean carriers have been quick to respond to the declining volumes by cutting capacity on a number of Asia-Europe and Asia-North America trade lanes through the use of blank sailings. This cut in supply has maintained enough upward pressure on spot rates to help them level off from the recent drop they experienced, and if volumes surge post-lockdown in China, it may be enough to push spot rates higher.

It is also worth monitoring and keeping track of the developing data around the monkeypox virus that seems to already have spread to more than 15 countries. The CDC is already providing guidance around it to health professionals, and it is very possible that if it maintains its current pace of infection, it could be declared a new pandemic. Also, keep in mind that there is still a war going on between Russia and Ukraine that is causing major disruptions in the flow of food and fertilizer (among other commodities) and could be one of many other factors (i.e., potential fuel shortages, record inflation, etc.) that some are warning could cause a global famine if not addressed appropriately. These are two developing situations that could become our next “black swan” events.

Watch: Carrier update

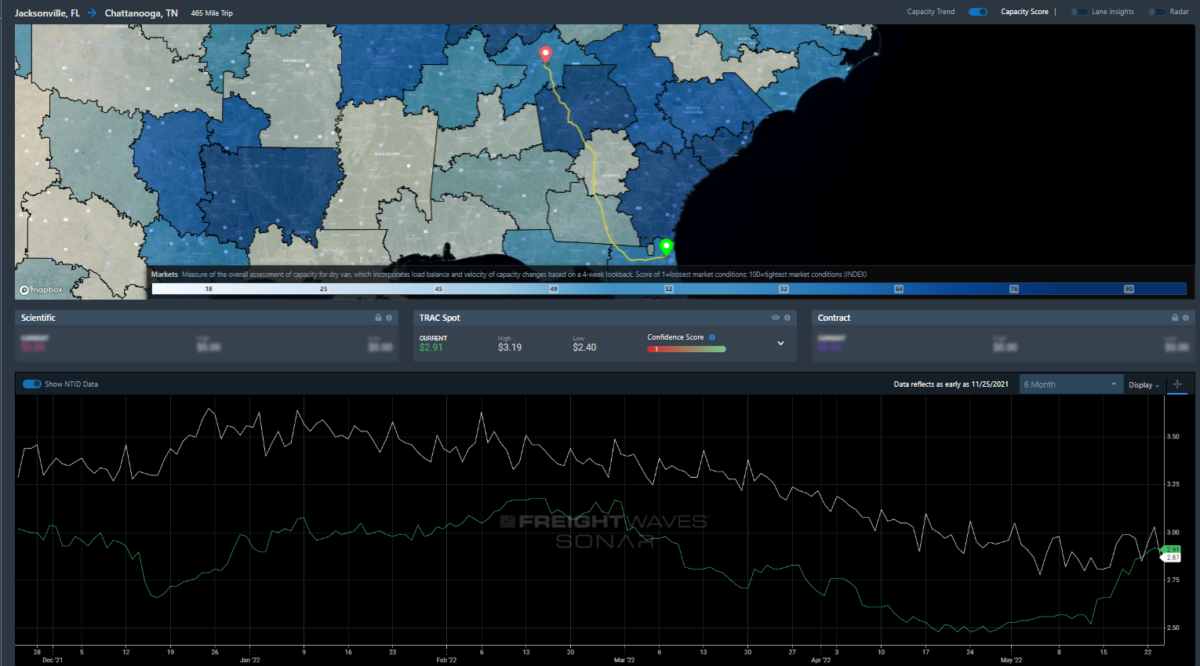

Lane to watch: Jacksonville, Florida, to Chattanooga, Tennessee

Overview: Jacksonville capacity gets a double hit from the holiday impact.

- Jacksonville’s outbound rejection rate continues to push higher, hitting 17% for the first time since late March. Rejection rates in this lane have increased from 8.5% on May 13 to 13.1% now.

- Spot rates have jumped 15% in this lane since May 13, which is well above the market average of 3.5% during the same period.

- Chattanooga’s rejection rate jumped from 9.3% to 11.5% on Tuesday.

What does this mean for you?

Brokers: Prioritize the Jacksonville market. Pad margins on just about any load you are uncertain of at this point, but more so to Chattanooga than any other market. Jacksonville was tightening independently of the holiday, but that has made the market more sensitive to its impact.

Carriers: Expect spot rates to pay much better than they did a few weeks ago out of Jacksonville. Accept more loads into this market as reload potential is on the rise.

Shippers: Push lead times out past the holiday period in Jacksonville and in this lane unless you are ready to pay premiums. Double-check with your carriers for anything scheduled to pick up over the next week.