The highlights from Tuesday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market Watch for Oct. 11:

Ontario, California

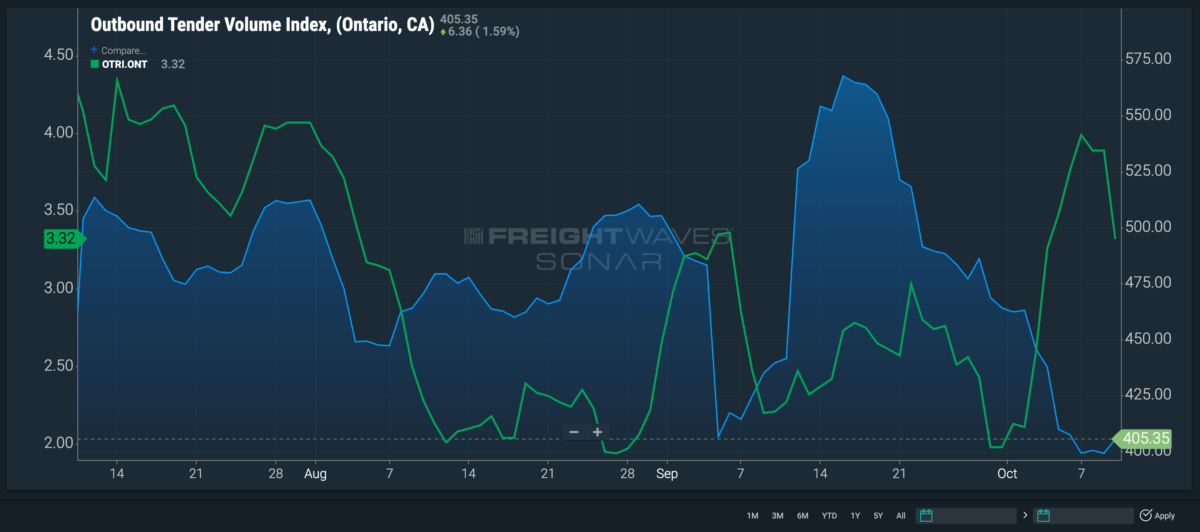

Volumes out of Ontario finally found a floor after a decline that lasted nearly a month.

Since Sept. 16, the Outbound Tender Volume Index in Ontario is down 162 points, or 28.5%, to 405.3 — its lowest value since May 2020. Volumes did, however, edge upward 1.6% this week.

Rejection rates surged while the market softened, as the Outbound Tender Reject Index hit 4% last Friday before trending back down this week to 3.3%.

Overall truckload demand in the U.S. has been trending ever so slightly downward during this decrease in volumes from Southern California. And though it will take quite a while for Ontario to make up the lost ground, the slight uptick this week will hopefully be the beginning of peak season volumes that will continue to grow.

Elizabeth, New Jersey

Outbound demand in Elizabeth has been trending down since the final week of September, bringing rejection rates down with them.

Imported container volumes to the Port of New York and New Jersey that are cleared through customs and ready to hit the surface transportation markets are down 36% from last month, and outbound truckload volumes from Elizabeth are down 3.5% in the same time frame.

The Outbound Tender Volume Index for Elizabeth dropped more than 7 points at the start of this week to a two-month low of 272.5. Meanwhile, rejection rates trended down as well, falling 35 basis points to 4.7% — the lowest since May earlier this year.

NTI as a point of reference

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.

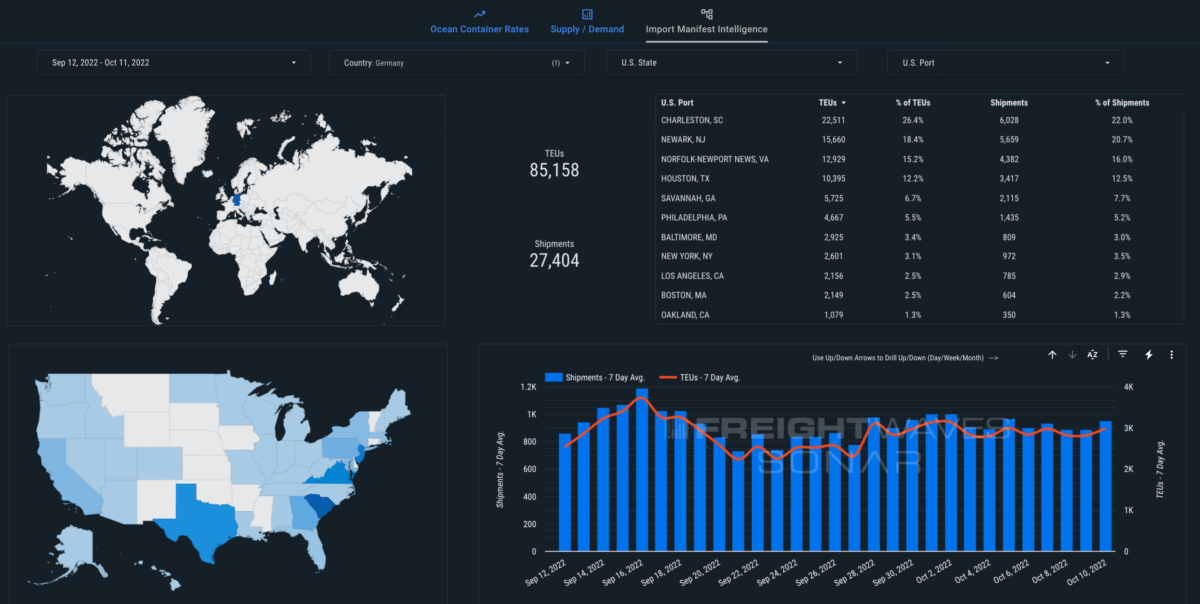

Maritime lane to watch: Germany to US

Rotterdam, Netherlands, is home to the largest port in Europe and where the continent’s largest economic power, Germany, ships out its exports. Spot market rates from the Port of Rotterdam to New York are up 8.4% in the last week to $7,252 per forty-foot equivalent unit, according to Drewry World Container Index. The rate increases as import demand from Germany continues to climb.

Imported volumes from Germany to the United States are up 32% from this time last month and up 83% since June. The increased volume is putting pressure on ocean capacity, as shippers are increasing their booking lead times by two days since last Thursday to more than 10 days.

The majority of the imported containers from Germany are being imported through the Port of Charleston, South Carolina, as the Southeastern port cleared 22,511 twenty-foot equivalent units in the last month.

JennaCoria

Making more income each month from domestic extra than $26k simply with the aid of using doing easy reproduction and paste like on line activity. I even have received $18635 from this clean (nau-30) domestic activity Everybody can now makes more money on line without difficulty with the aid of using.

simply follow=====>>> http://salaryapp1.blogspot.com/