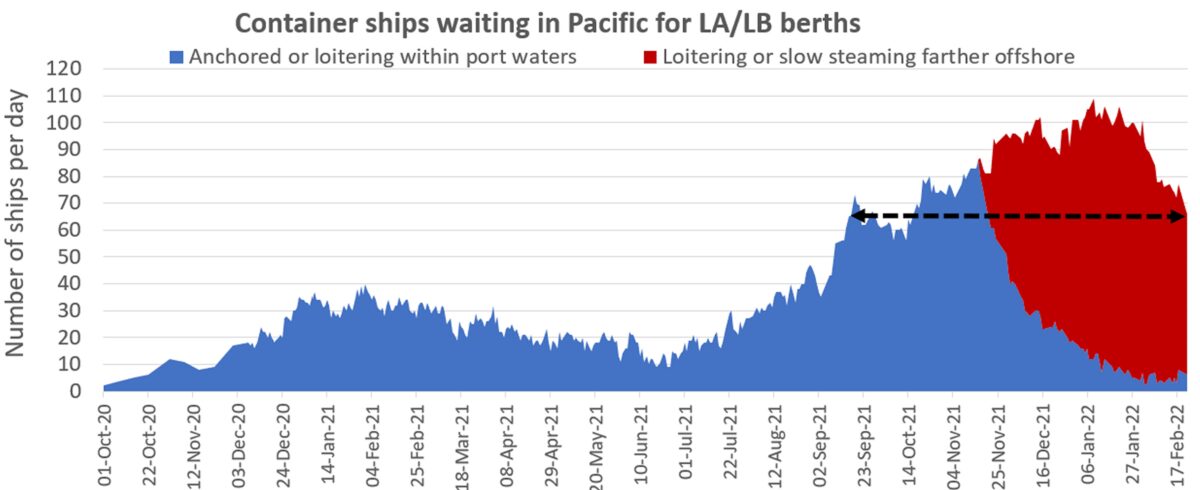

The good news on U.S. port congestion: The number of container ships waiting for berths in Los Angeles/Long Beach has continued to decline, falling to 66 on Wednesday — as low as it was back in mid-September.

The bad news: Other indicators point to ongoing challenges for West Coast ports and a potential resurgence in queue numbers in March, April and May. Meanwhile, the number of ships waiting offshore of East and Gulf Coast ports is hitting new highs, and sailing schedules show that these ports will also see imports surge over the coming months.

Gains in Southern California are being offset elsewhere. The queue of waiting ships off Los Angeles/Long Beach has shortened, but the queue including all ports countrywide has not.

Los Angeles/Long Beach

In January — when the ports of LA/LB were able to free up space and unload more imports than in November and December — the number of ships waiting offshore stayed fairly steady, averaging 102 per day. This month, the number of ships waiting off LA/LB has fallen by 35% from 101 on Feb. 1 and by 39% from the all-time high of 109 on Jan. 9, according to statistics from the Marine Exchange of Southern California.

The queue could be declining because landside bottlenecks have further eased compared to January, or because there have been fewer ship arrivals due to the Lunar New Year holiday in China. Data from Sea-Intelligence strongly implies the latter explanation.

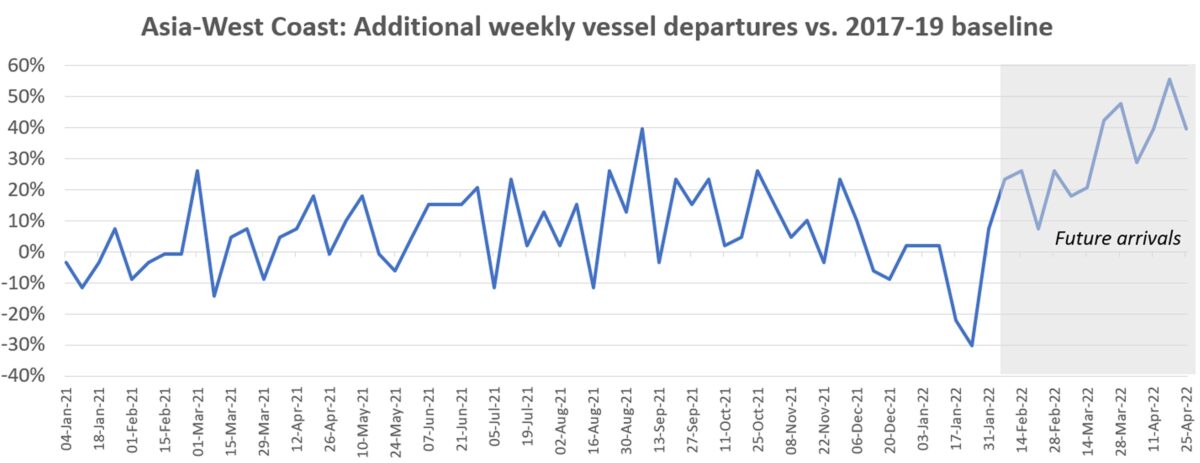

Sea-Intelligence analyzed the number of deployed ships in the Asia-North America West Coast trade per week (based on week of departure not arrival) and compared those to pre-COVID 2017-19 averages.

The data shows that weekly scheduled departures plunged to 22% below the average during the week of Jan. 17 and to 30% below average in the week of Jan. 24. Given the trans-Pacific transit time, this would cut the queue in February.

The Sea-Intelligence numbers reveal that the scheduled departures have not only rebounded since then but are about to shoot much higher. Scheduled departures are up around 16% in February compared to the 2017-19 average. In the third week of March through the end of April, departures will be up 40% or more versus pre-COVID levels.

Sea-Intelligence CEO Alan Murphy warned, “The number of vessels scheduled to depart Asia and subsequently arrive on the North American West Coast will increase sharply. This will add further pressure on the port infrastructure.”

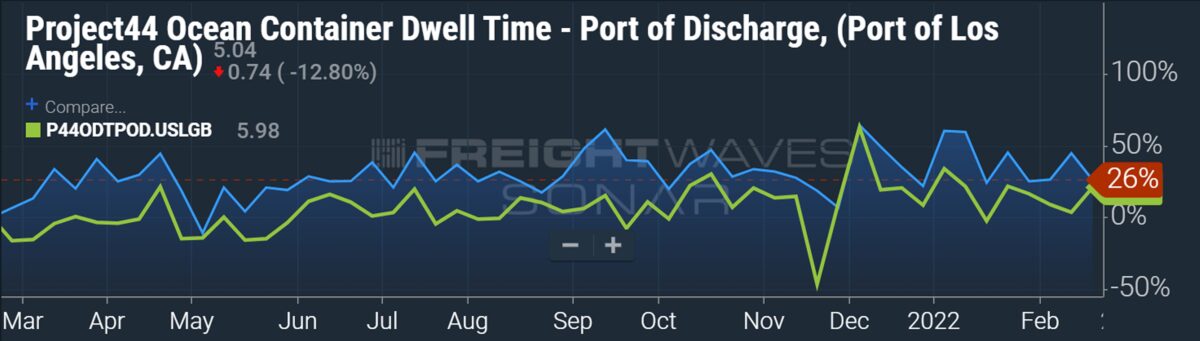

Data on container dwell time from project44, which is now available on FreightWaves’ SONAR platform, provides visibility on landside bottlenecks.

The data shows there is a lot more digging out to do. This week, the average container dwell in Los Angeles is up 26% year on year and up 21% year on year in Long Beach. On a positive note, container dwell time is down 23% in Los Angeles from the peak in the second week of December, with Long Beach down 26% from that high.

East/Gulf Coast ports

It’s not just the Lunar New Year lull that’s helping LA/LB reduce its ship queue. It’s also that more volumes are shifting to the East and Gulf Coast ports instead.

According to John McCown, publisher of the McCown Report, “January was the eighth straight month where overall growth at East/Gulf Coast ports exceeded overall growth at the West Coast ports.” He attributed the trend to “shippers changing routing decisions to avoid the widely reported West Coast congestion.”

S&P Global Platts reported this week that Asia-East Coast rates are currently being supported “by growing demand as shippers seek to avoid West Coast port congestion.” A freight forwarder source told Platts, “We’ve seen suppliers in China reaching out to their importers in the U.S. with imperatives to get goods out of their warehouses and take those cargoes to the East Coast, which is the only realistic option for many of them right now.”

Sea-Intelligence ran the same analysis of weekly departures for Asia-East Coast ships as it did for West Coast routes. It found that the coming wave of cargo is even bigger in the East Coast than the West Coast.

According to Murphy, “What is alarming is that there is a 60% increase in the number of vessels on the Asia-North America East Coast trade lane in the coming months, as carriers try to circumnavigate port congestion on the West Coast. This will severely increase pressure on the port infrastructure on the East Coast.”

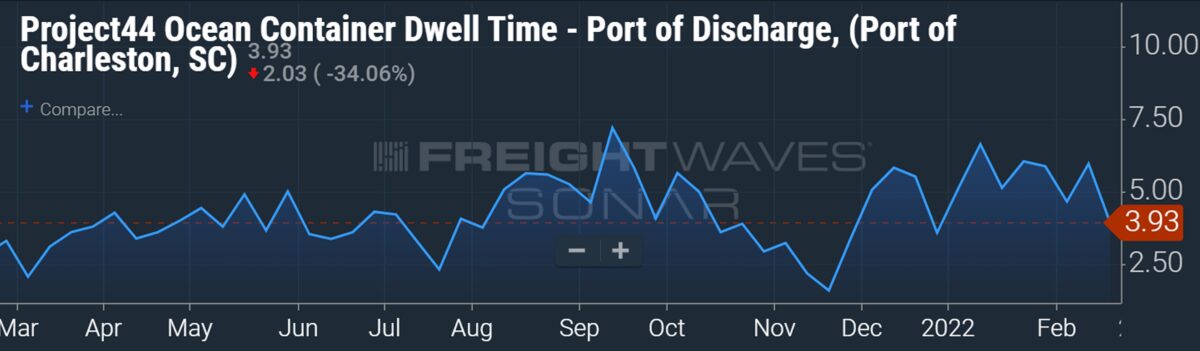

That pressure is already high, particularly in Charleston. On Wednesday, there were 31 container ships anchored offshore, according to ship-positioning data from MarineTraffic. Project44 data shows that average container dwell time in Charleston this week is up 37% year on year.

Hapag-Lloyd reported that ships are waiting between five and nine days for berths in Charleston and “berth windows are not being honored,” with the port “metering in import-heavy ships, with priority given to ships with more exports than imports and that are loading 1,000 TEUs [twenty-foot equivalents] or more of empties.”

Other East and Gulf Coast ports are seeing ship queues lengthen, as well. On Wednesday, there were 13 container ships anchored or loitering off New York/New Jersey, where Hapag-Lloyd said “high berth and terminal utilization are expected to continue into the second quarter.” There were another 13 container ships off Virginia, 12 off Houston and one off Mobile, Alabama, according to MarineTraffic data.

Add it all up and there are 70 ships waiting to get into East/Gulf Coast ports, four more than there are waiting to get into Los Angeles/Long Beach. Over on the West Coast, add in another 10 ships waiting for berths in Oakland and one more off Seattle/Tacoma, and the grand total for the country’s ports rises to 147 — the same countrywide level as in early January, when the LA/LB queue was at its historic peak.

Click for more articles by Greg Miller

Related articles:

- Glimmer of hope: Has the ship gridlock off ports finally peaked?

- Ports of LA, Long Beach clear containers, set January records

- Cartel? Liner competition increased as trans-Pacific rates spiked

- Supply chain chaos and port gridlock could drag on into 2023

- Container shipping has greatest quarter ever — with more to come

- Imports take ‘dramatically longer’ to reach US as bottlenecks bite

- New year brings new all-time high for shipping’s epic traffic jam