The fifth-largest trucking carrier in the country, Yellow (NYSE: YELL) is teetering on the edge of bankruptcy as a dispute between management and the International Brotherhood of Teamsters, the union representing the truck drivers, threatens to massively disrupt operations next week.

There’s reason to believe that Yellow’s board’s decision not to make a $50 million payment into the Teamsters’ pension fund signals an intention to file for bankruptcy in the near future. And if Yellow doesn’t pay, the Teamsters union has said it will strike on Monday, a move that might end the company, with its estimated 13,800 tractors and 43,400 trailers, in its own right.

Yellow represents about 9% of the less-than-truckload industry’s total capacity, with disproportionate market share in the Midwest, where subsidiary Holland is based, and the Northwest, home of Reddaway. It will take some time for other LTL carriers to absorb Yellow’s volume if the carrier shuts down abruptly. Many carriers are already taking as much as they can, as Yellow’s freight bills per day have fallen by more than 30% in recent weeks, according to a source close to the carrier.

When Celadon shut down in December 2019, the truckload industry readily absorbed the volume, but truckload networks are inherently more flexible than less-than-truckload. Truckload networks are not bound to physical real estate, the infrastructure of service centers and cross-docks, where less-than-truckload shipments are deconsolidated and rebuilt into linehaul shipments across zones. Truckload carriers routinely shift dozens of over-the-road trucks from one region to another to balance the capacity in their networks — but it’s more difficult for LTL carriers to do this.

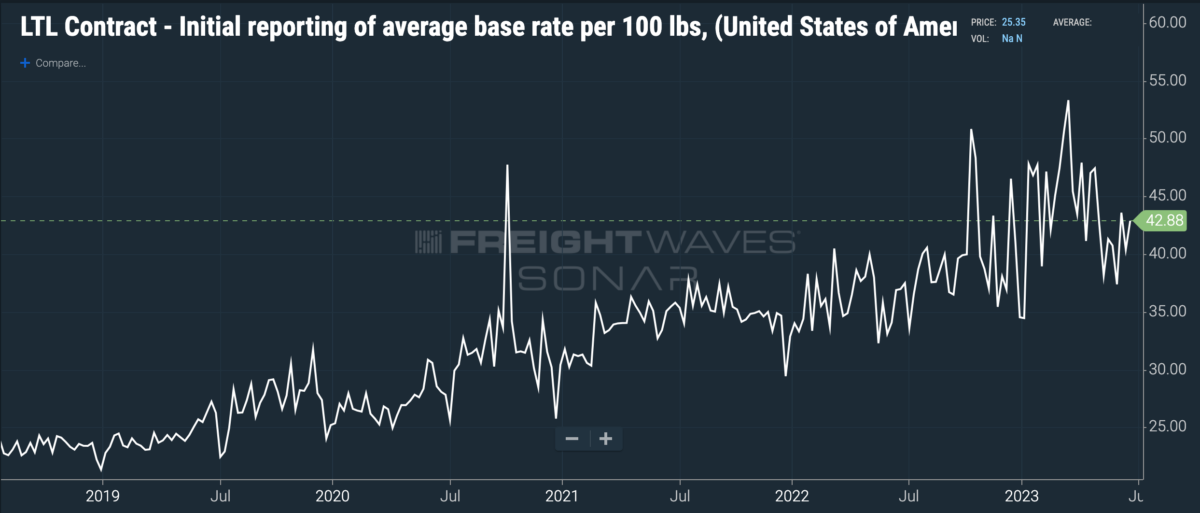

Further, the LTL carriers believe that they have the wind at their backs. Less-than-truckload contract rates have held up better than in most other modes of transportation.

The direction these rates begin to move in over the next week, as the impact of more displaced volumes begin to be felt in LTL networks, will give shippers a good sense of how tight or loose LTL capacity truly is as they prepare for the fourth quarter.

While LTL contract rates are off their peak earlier in the year, carriers are getting paid more per hundredweight now than they were in 2022 or 2021. LTL carriers have been more disciplined on price than the truckload market, picking and choosing the right freight at the right price. LTL carriers will likely try to raise contract rates by 9% to 12% in the months after Yellow’s capacity is removed from the market.

Why? First, most LTL carriers provide better service than Yellow does. According to Mastio’s LTL Customer Value & Loyalty Report for 2022, a survey of LTL shippers about their transportation providers, Yellow had one of the lowest Net Promoter Scores, 16.32%, in the industry. A shipper switching from Yellow will generally be switching to a higher-quality, more expensive carrier. Add to that the fact that the LTL carriers have largely retained pricing power and you start to see a situation in which the carriers have an opportunity to ratchet up contract rates and make them stick at a higher level.

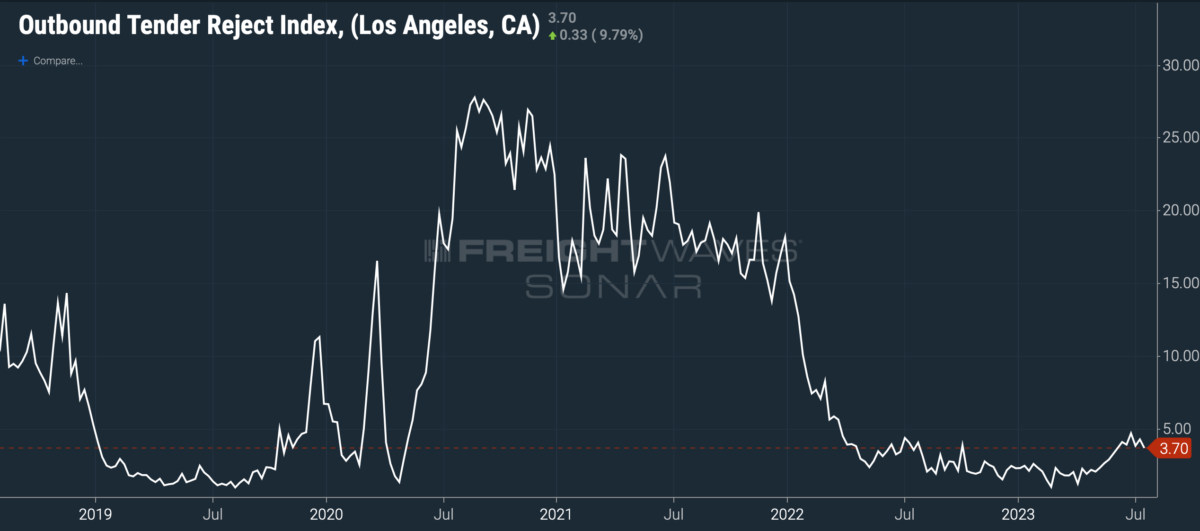

One of the trickier parts of Yellow’s network, LTL industry sources tell FreightWaves, is its long-haul retail freight. Shippers would do well to pay attention to outbound tender rejection levels in Southern California to monitor the truckload capacity situation to see if excessive overflow volumes end up impacting that market.

If both LTL contract rates and Los Angeles tender rejections begin to pick up over the next week, we should take that as a signal that Yellow’s exit is putting pressure on trucking capacity in both LTL and TL and the market may be turning a corner. On the other hand, if LTL contract rates and LA tender rejections stay flat or go lower, then we will know that the LTL industry had plenty of excess capacity ready to absorb Yellow’s volumes, and shippers can go forward with their Q4 plans with confidence.

For now, it appears that shippers will bear a significant burden in repricing their freight and arranging for new carriers — it won’t be as easy as simply pushing these shipments out as overflow freight on their current contracts. Whether the disruption is enough to spark a small brush fire in truckload is an open question.

Mark

Yellow’s demise is by design. The teamsters have given up 15% of their wages over the yrs to keep Yellow afloat and this made the employees the least compensated in the LYL industry. With that advantage Yellow still couldn’t/ wouldn’t show a profit . If you couldn’t make money from 2010 til now, you’re either incredibly incompetent or skilled at losing. Everything from acquiring Roadway and the USF companies to operational decisions strongly suggests this was nothing more than corporate raiding. They bled the employees until they wouldn’t give anymore and ran up as much debt as they could, now pull the plug and go find another victim company to exploit. After all, it’s not their lives they are ruining.

Mike

Dave Trusky, Correct me if I am wrong. but aren’t Yellow Teamster only being credited 1 year for every 4 years of service in regards to the pension?

Mike

In fact Scott, YRC began to so deeply discount their freight services in 2007-2008 that it began to cause a slide in pricing across the entire LTL sector and inducing customer loss by other carriers just so they could gain tonnage and business by increasing their customer base. All that did is create a lull and to themselves basically giving their freight away for probably a quarter of every dollar or less. And none of that helped Yellow Teamsters or anyone else who lost wages, etc. And there as a company is so much worse off than they were even some 15 years ago since the official beginning of the last recession.

Mike

How do you figure that Scott? I work for ABF. I know Yellow both retired and present who’ve lost wages, benefits, and their pension value since 2010 when the IBT accepted a deal on their behalf between the YRC Teamsters and Yellow Roadway Corporation and the companies they bought, to help ease the financial pressure and help that company survive as a result of a $966 million loan debt used to make the Roadway purchase in 2003. Then they get $700 million, so then their debt swelled to $1.666 billion. To this day according to many financial articles just in July of this year 2023, they still by estimates, owe $1.3 to $1.5 billion. And since they’ve lost more than $100 million in 2019 I’m very interested to read how you think everything would be just peachy if Craig and his buddies would simply have accepted that wonderful change of operations at the beginning of the year? How is Yellow supposed to get back in the black when their even in much more debt now than they got themselves into some 20 years ago, because I don’t know what else the Union members are suppose to give to that company when they’re now at the 13 year mark since the initial giveback. You’re just flat out incorrect. And to be honest, I think you owe Craig a damn apology.

Dave Trusky

Teamsters have been giving back for 15 years, 15% of wage’s, weeks of vacation. Time to let Yellow fail! No amount of money is going to save them

BB

I’m a 32 yr employee and 2008 I’ve given back and back then Yellow LIED and continues to LIE it’s a SHAME a company this BIG FAILED the AMERICAN PEOPLE don’t blame the UNION show US ALL the MONEY TRAIL $700m and I’ve seen NOT ONE Improvement

Scott

Craig, do you really believe what you said. First off, the union has not done everything to help Yellow stay alive. if the union accepted the change of operations back at the beginning of the year like what was done last year in the West, then Yellow would be thriving. It is public record where the $700 mm went, buying new equipment and employee benefit contributions.

Craig

First to Scott. The teamsters union and the members have done everything to help Yellow stay alive. The Management are to blame for this. Where did 700 million go ? Members gave back millions. Teamsters stood strong and for the future.