In an extraordinary video, the head of the largest brokers trade association defended his industry from the online and on-the-highway criticisms from carriers facing increasingly weak freight rates.

Bob Voltmann, president and CEO of the Transportation Intermediaries Association (TIA), took to YouTube with a roughly three-and-a-half-minute video in which he ripped views of the market that “some snake oil salesman would have you believe.”

“There’s a lot being said about truck rates and brokers today,” Voltmann said. “Brokers don’t set prices. The market does.”

The video comes as some small protests by truckers on highways have called for higher trucking rates. In some of those protests, like the one depicted in the picture accompanying this story, brokers have been portrayed as the villain in the plunge in trucking rates. Online, the vilification of brokers in various Facebook groups geared mostly toward drivers has been ramping up considerably.

Voltmann noted that the U.S. has shut down huge portions of its economy as a result of the pandemic. “And since mid-March, rates have plummeted,” he said. “Nobody is getting pre-virus rates.” It is the belief that some people are getting those higher rates that led to his statement about unidentified “snake oil salesmen.”

Much of the online chatter does involve some drivers saying, in essence, just park your trucks and wait for the rates to come back. Voltmann addresses this concept while talking about how rates are set in a market he describes as “huge, fractured and incredibly transparent.”

“Shippers, like all buyers, want to get the lowest price possible,” Voltmann says in the video.

“They know there is not enough freight to fill all the trucks. Shippers and brokers offer rates to probe the market. Shippers do it to brokers, and brokers do it to carriers.”

If the market doesn’t go through what economists call “clearing” at the numbers in the “probe,” higher numbers will be discussed. “If carriers don’t accept the rate, shippers and brokers will offer higher rates until the load is accepted,” Voltmann said. “That’s the free market economy that allows owner-operators and small carriers to operate.”

In a phone interview with FreightWaves, Voltmann conceded that the video “isn’t the type of thing I normally do. But these are not ordinary times.”

As a result of low rates, Voltmann said smaller carriers, like independent owner-operators or small firms, “are lashing out at my members. I thought this was something that was needed to put out there.” He described his arguments in the video as “economics 101.”

Voltmann also said TIA had been receiving phone calls from their members “looking for positive news or industry things they could point to.”

“Rates are down, margins are down across the board,” he said. “No one in America is fat, dumb and happy right now.”

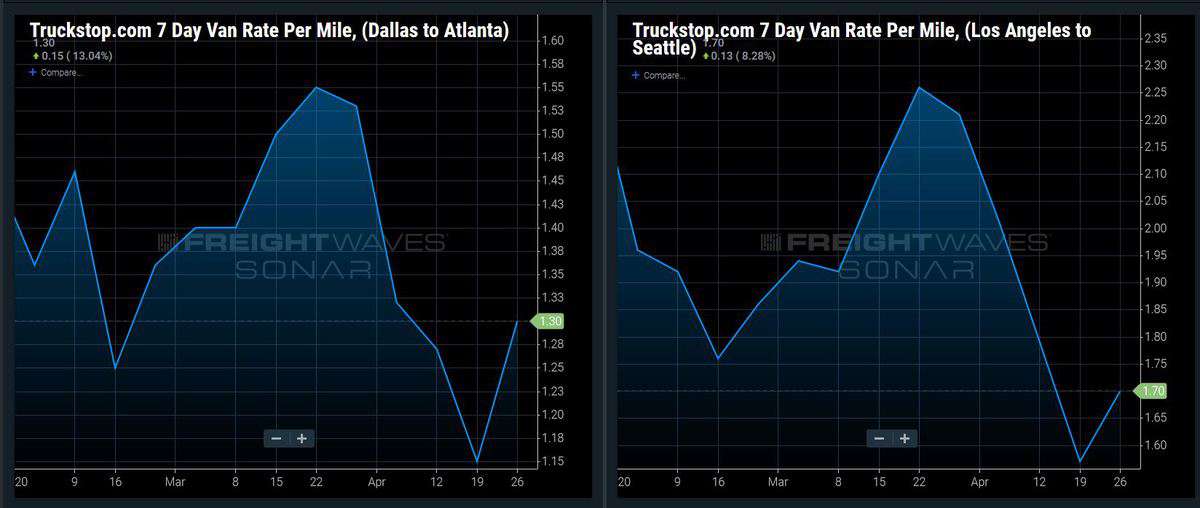

The irony of the video is that it comes as there are some signs that the market may be turning. According to the weekly data on rates published by SONAR and supplied by Truckstop.com, rates have taken an upturn.

For example, the Dallas to Atlanta lane posted a per-mile rate of $1.55 on March 22. It dropped to $1.15 on April 19 but a week later, in the most recent update, it was $1.30.

Similarly, the Los Angeles to Seattle late was $2.26 per mile on March 22, dropped to $1.57 per mile on April 19 and rose to $1.70 in the most recent update.

Voltmann cited the TIA 3PL market report. He said in the latest edition of that internally generated report, which comes out quarterly, brokers reported their average margin was 16%. “That means that if the shippers pay $1,000 for a load, the brokers keep $160 or 16% to cover their costs in manning a sales force to get the load and find the carrier, and their investment in technology to manage the shipper’s load and their profit,” Voltmann said.

In the economics of that transaction laid out by the TIA chief, the carrier gets $840, “84 percent of the gross margin to cover their costs of equipment, maintenance and profit.”

“The motor carrier gives up that $160 so they don’t have to have their own sales force and their own investment in technology to manage the shipper’s load,” Voltmann said.

And in a statement sure to spark some friction with carriers who are already angry, Voltmann said there exists a “yin and a yang between the brokers and the carriers. Neither can survive without the other.”

A recent post on the popular Rate Per Mile Masters group on Facebook lays out where the two sides of the debate are coming from. A broker posted a question: “If you feel that you are getting ripped off by the broker then why not go to the shipper and let them know how much their broker is paying you? Ask them if they think the broker is making a fair profit off of them.”

And while there was plenty of grumbling in response to that, but in some cases sort of an agreement, the question was raised about why in a technology age, brokers are even needed — a question that comes up about all middlemen as technology advances. “My question has always been, WHY [his emphasis] do we “need” a middleman eating up double digit amounts of what would have been a fair rate?” one commenter wrote. “In the age of internet, all shippers should be able to post their own loads and pay a carrier directly.”

The full video can be seen here.

A Driver

Brokers don’t set the price, the market does…. You get what you pay for dear SIR. When the market rebounds please remember your own words, because truckers will survive and ask the government for real transparency in this business. Hope you are held responsible for all the detention money, extra stops, fuel surcharge and all the other trickery you used to steal money from people. God sees it all!

His and her logistics

I had a broker slip in an extra stop on rate com and when I called him and told him it would be another 3-500 he said no and canceled me all together…. oh well it will sit in the board

JT Williams

You can thank Jimmy Carter for all the Voltmann’s out there in the trucking world. Voltmann is a liar. The first four letters in broker is broke. They take 60 percent off the top and leave you just enough for fuel. They tell you FSC is included in the rate. Total bullshit! Thats why the big broker conglomerates make billions each year. My heart pumps purple piss water for ya Voltmann! Go fuck yourself!

Rev. Danny Santos

This guy is another fat cat that is another big head scammer and needs to not make a penny for 3 mths like we have in the last 2 yrs – brokers have no clue to real sacrifice they cry they can’t be fat we cry because we can’t eat nor get our grand kids Christmas gifts to keep businesses afloat until market rebounds – we have been waiting since Dec 2018 and it rebounded just for the brokers – this guy is why there is such a divide between the two carriers and brokers because he don’t have a clue what we do.

Ali

We will listen he is saying all we know is we th carriers are getting 35% of what the shipper is paying and we do the hard work.

Brian B

To answer the last question…..the shippers won’t post their loads themselves because then they take on the risk of their load being stolen. A good broker goes through a screening process with the carriers they use. If something happens to a customer’s load using a broker, they are basically fully covered. That is not the case if they are choosing who to give their loads to. The shippers then need to pay a worker (or likely more workers) to perform these daily load posting tasks.

Dave

There is nothing wrong with the concept of a broker – it makes sense. The problem is that there is no honor code that anyone sticks to. For example, if the govt (or the TIA) said that the broker MUST pass on a minimum percentage amount of the load to to carrier and take just a fair profit for themselves without killing the carrier that may work. But it is such a dog eat dog world today. Everyone is to blame….everyone. The system is just plain broke. In life, everyone has to win “a little bit” to stay alive. Otherwise it all falls apart.

Doc

Brokers don’t set prices. Brokers “Fix” prices. They’ll play one shipper or trucker against another until they inflate the rates. The problem in todays world is there aren’t enough loads or customers for them to do this. Voltmann is the same dude that whined that brokers couldn’t afford the increase in the bond. Brokers are the lowest form of life in the transportation world. A festering pustule on the buttocks of the trucking business.