Despite lower net income and revenue in the first quarter of 2019, Daimler AG (DAI.XE) reported on April 26 that it expects to see slight earnings and revenue growth for the year.

Daimler, headquartered in Stuttgart, Germany, stated that its net profit for the period ending March 31 dropped to €$2.1 billion from €2.4 billion a year earlier. (All financial figures in euros; 1 euro = $1.12.)

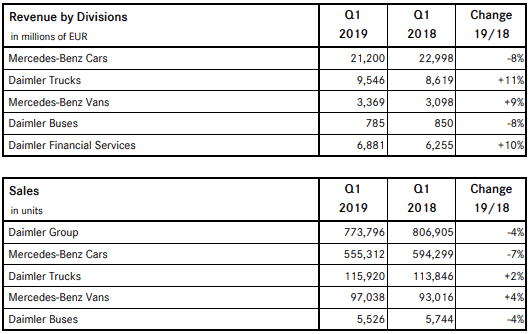

Revenues dipped slightly in the first quarter of 2019 to €39.7 billion, down from €39.8 billion in the first quarter of 2018. The company’s earnings per share for the first quarter were down 8 percent to €1.96, down from €2.12 a year earlier.

The company said it sold 773,800 vehicles, commercial vehicles and passenger cars during the first quarter of 2019, down 4 percent from the first quarter of 2018.

“We had a comparatively weak start to the year and face numerous challenges along the entire value chain in all our automotive divisions,” said Bodo Uebber, member of the Board of Management of Daimler AG. “This had a negative impact on unit sales and earnings.”

Uebber announced on the company’s first quarter earnings call that he will leave Daimler in May.

He said on the call that the company remains focused on developing Level 4 autonomous vehicles, highlighting Daimler Trucks purchase of the majority stake in Torc Robotics, another play in the company’s efforts to expand its presence in the self-driving commercial vehicle market.

Daimler Trucks, which is the parent company of Freightliner and Western Star trucks and has the largest market share in the heavy-duty market, posted a slight increase in sales of 2 percent in the first quarter of 2019 to 116,000, up from 114,000 in the year-earlier quarter. Sales in the NAFTA region rose 17 percent to 47,800 from 40,800 the previous year.

In Latin America (minus Brazil), sales dropped 7 percent to 8,700 trucks from 9,400 a year earlier. However, during the first quarter of 2019 sales were up 51 percent in Brazil from a year ago. In the European Union, sales during the first quarter of 2019 jumped 10 percent to 19,000 trucks, up from 17,300 a year ago. Sales of trucks in Asia dropped 9 percent to 34,300 from 37,700 in the first quarter of 2018.

The uncertain economic climate in Turkey contributed to a steep decline in truck sales there, from 1,800 to 500 vehicles in the first quarter of 2019.

On the call, Uebber said higher material costs and supply chain constraints held down revenue in its Trucks division.

“Above all, high inventories and bottlenecks in the supply chain had a substantial negative impact on cash flow,” Uebber said. “Nonetheless, we will continue to invest in our future – sensibly and with a clear focus.”

First quarter 2019 truck orders dropped significantly, down 45 percent to 101,400 from 183,800 compared with the same quarter in 2018.

However, Daimler Trucks’s quarterly earnings rose 11 percent to €9.546 million, up from €8.619 million a year earlier.

“In addition to the increase in unit sales, especially in the NAFTA region, exchange-rate effects had a positive impact on earnings,” Daimler said its report.

Daimler expects its Trucks division will continue to experience slight truck sales increases in 2019 in both NAFTA and the European Union regions.

Daimler’s Mercedes-Benz Vans division saw a 9 percent increase in revenue to €3.369 million, up from €3.098 million a year ago, selling 97,000 vehicles, its strongest first quarter to date, the company said.