Universal Logistics Holdings (NASDAQ:ULH) reported on Thursday that its profits fell by almost 30% during the first quarter as COVID-19-related slowdowns in manufacturing and retail hit its truckload and dedicated operations.

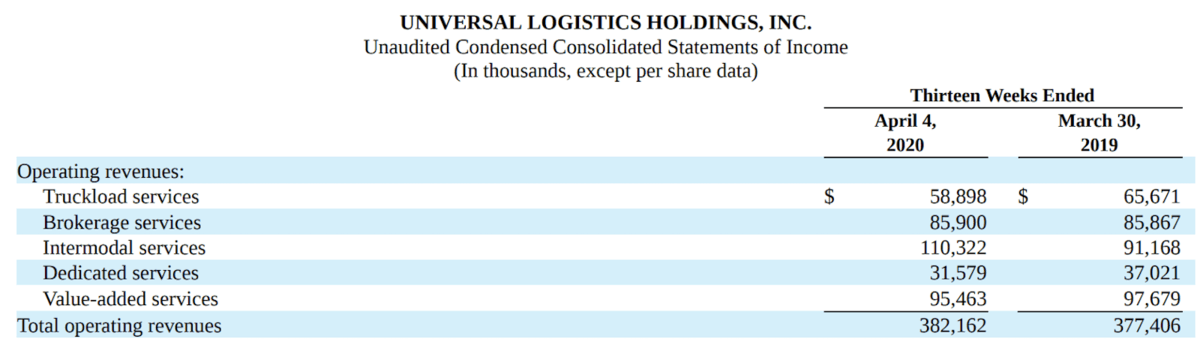

Universal Logistics had a net income of $12.2 million, or 45 cents per share, on $382.2 million in revenues during the quarter. Net income came in 29.4% lower than a year earlier, while revenues increased by 1.2%.

CEO Tim Phillips characterized the results as “pretty solid” in the context of the COVID-19 pandemic.

“We started off the year with high expectations, but as the virus overwhelmed our international trading partners, particularly China, and then rapidly spread here at home, it became increasingly apparent that the negative impact would last longer than everyone originally predicted,” Phillips said in a statement.

The company withdrew its 2020 earnings forecast and temporarily suspended its dividend of 10.5 cents per share. Universal also said it had furloughed an undisclosed number of employees.

The slowdown in demand for retail and manufacturing and the shutdowns of automotive and heavy-truck plants hit multiple segments.

Michigan-based Universal’s truckload and dedicated operations saw the worst of the coronavirus impacts as slowdowns in retail and manufacturing eclipsed higher demand in essential consumer goods. Truckload revenue dropped by 10% to $58.9 million, while dedicated revenue fell by 14.7% to $31.6 million.

Despite intermodal revenue jumping by 21% to $110.3 million, Universal noted that COVID-19 weighed on its Southern California operations. Southern California’s intermodal revenue fell by $8.2 million during the quarter as loads plunged by 40%.

Universal’s brokerage services remained flat during the quarter, accounting for $85.9 million in revenue. Value-added services revenue fell by 2% to $95.5 million.

Phillips said Universal is well-positioned to recover as lockdown orders get lifted and production resumes at auto and truck plants.

Phillips will discuss the results with analysts during a conference call on Friday.