The first paragraph of Hapag-Lloyd’s news release Thursday on the German ocean carrier’s performance in the first half of 2023 ticked off earnings before interest, taxes, depreciation and amortization of $3.8 billion, earnings before interest and taxes of $2.8 billion and group profit of $3.1 billion.

“As expected, these results are significantly below the prior-year level,” it said.

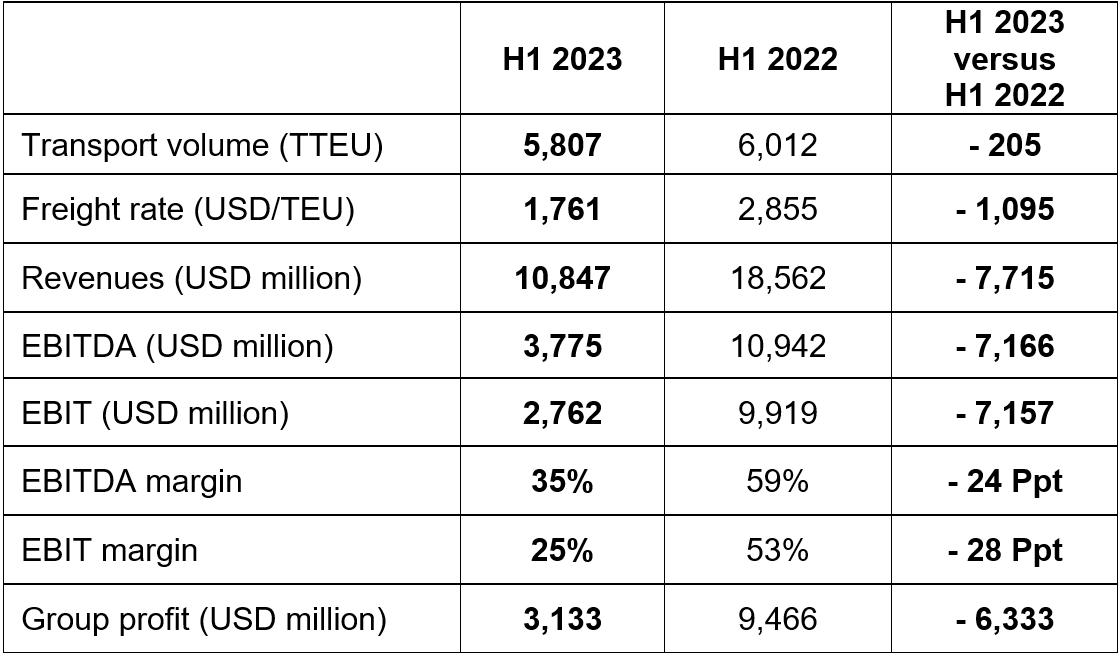

Just how far below the results of the first six months of 2022 is not apparent until a chart at the bottom of the news release. EBITDA and EBIT both plummeted by more than $7.1 billion — from nearly $11 billion and almost $10 billion, respectively. Group profit plunged $6.3 billion from the nearly $9.4 billion posted for the first half of 2022.

Revenue for the first half of 2023 dropped by $7.7 billion, from $18.5 billion in 2022 to $10.8 billion. Hapag-Lloyd blamed much of the revenue dive on a lower average freight rate of $1,761 per twenty-foot equivalent unit. That’s down by more than $1,000 from the average rate of $2,855 per TEU in the first half of 2022. Transport volumes also declined 3.4% year over year.

“Weaker demand and lower freight rates are having a very noticeable impact on our earnings. In a challenging market environment, we can look back on a successful first half year overall, in which we were able to expand our terminal portfolio while also significantly boosting our customers’ satisfaction thanks to our focus on quality,” Hapag-Lloyd CEO Rolf Habben Jansen said in a statement.

Hapag-Lloyd confirmed the full-year forecast it issued in March of EBITDA for 2023 of $4.3 billion to $6.5 billion and EBIT of $2.1 billion to $4.3 billion. That could be a $16 billion fall from what Hapag-Lloyd called an “extraordinarily strong result” in 2022 of $20.5 billion. Full-year 2021 EBITDA was $12.8 billion.

“However, the ongoing war in Ukraine, geopolitical uncertainties, persistent inflationary pressures and high inventory levels are creating risks that could negatively impact the forecast,” it said.

Habben Jansen said in the second half of 2023 Hapag-Lloyd will “continue to focus on formulating our ‘Strategy 2030.’ This strategy will guide us forward on our strategic path to success in 2024.”

Hapag-Lloyd reports ‘extraordinarily strong result’

Hapag-Lloyd acquires stake in Indian terminals, logistics provider

Hapag-Lloyd acquiring SAAM terminal operations in $1B deal

Click here for more American Shipper/FreightWaves stories by Senior Editor Kim Link-Wills.