COVID is not done with shipping yet. China is suffering its worst outbreak since the pandemic began. Shenzhen (population: 17.5 million) went into lockdown Sunday, closing factories. Cases have surged in Shanghai, where new restrictions are in place.

Shanghai is the site of the world’s largest port, Shenzhen the third largest. When a COVID outbreak hit the Yantian terminal in Shenzhen last June, twice as many vessels were delayed as in the Ever Given accident in the Suez Canal.

How the new COVID outbreak affects trans-Pacific container shipping depends on whether ports close along with factories, and if so, for how long, said George Griffiths, managing editor of global container freight at S&P Global Commodity Insights.

The worst-case scenario was described by Container xChange as “a major shockwave to an already crippled supply chain.” Bjorn Vang Jensen, vice president of Sea-Intelligence, warned in an online post that if Yantian closes, “the whiplash effect when it reopens will lay waste to all the progress (maybe being) made in the U.S.”

Positives and negatives

The worst case may still happen, but it hasn’t yet. Liner giant Maersk reported Monday that all ports in China, including those in Shenzhen, were operating normally and “remain business as usual.” Warehouses in Shenzhen are closed through Sunday. Warehouses in Shanghai and Qingdao remain open, although truckers require negative COVID tests to pick up cargo.

Griffiths told American Shipper, “If no ports shut down but volumes coming out of factories are reduced [by lockdowns] that actually would be pretty good for ports.” It would allow more backlogs at Chinese export terminals to get loaded on ships, and help to normalize supply chain flows without forcing carriers to “blank” (cancel) sailings.

If Chinese ports do close, causing ships to drop calls or blank entire sailings, it would be short-term positive for U.S. ports. But they’d pay the piper later.

“Any respite [U.S.] ports can be offered in terms of imports will be positive, given the number of containers that are currently quayside and the number of issues in the hinterland. It will allow an easing of those problems,” said Griffiths.

2021 Yantian closure

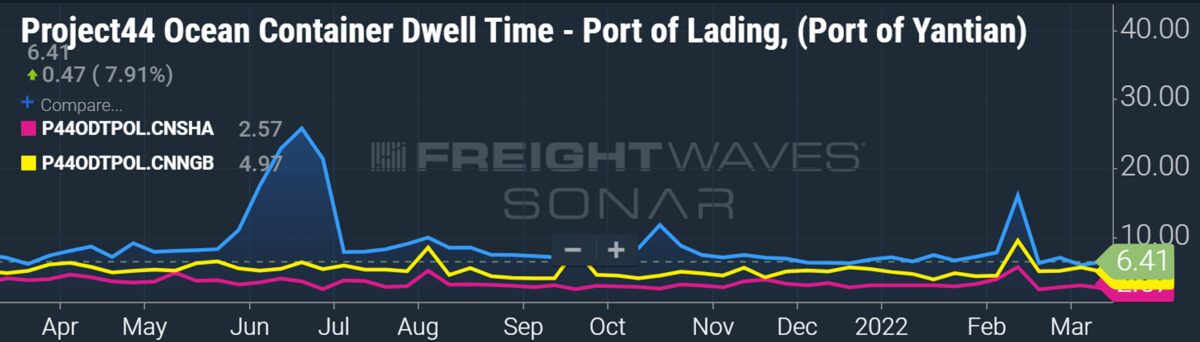

Data from project44 shows how average container dwell times in Yantian surged to over 20 days in the wake of last year’s shutdown, far above dwell times seen during Lunar New Year and Golden Week holiday periods.

The more containers stuck in China, the less bottleneck pressure in California. When Yantian shut down last year, the ship queue off the ports of Los Angeles and Long Beach dwindled to the single digits.

“But the demand was still there,” said Griffiths. “Just because it couldn’t move didn’t mean it went away. It just meant that the demand had to be compensated for at a later date.”

After Yantian reopened, the queue of ships waiting offshore of Southern California shot up throughout the second half of 2021. Rates rocketed to new heights. “Yantian was really the big driver last year. When we saw rates go stratospheric, it was because of the release of all that pent-up pressure that had built up in the market,” said Griffiths.

“If we see the [Chinese] ports start to close now, we could see what happened in 2021 start to play out again.”

Demand differences

There are important differences between market conditions today and at the time of the Yantian closure. Some could reduce the impact of a Chinese port closure this time around, others could increase it.

One difference is U.S. import demand. It was historically high in 2021 and appears to have at least temporarily slackened in 2022, beyond the normal Lunar New Year lull.

“We haven’t seen large volumes being booked for February or March, although April’s looking fairly tight. We’re seeing some improvement from where we were immediately post-Lunar New Year, but it’s still fairly tepid,” said Griffiths.

Going forward, the war in Ukraine could be a demand headwind. American spending is no longer being juiced by government stimulus and the war has increased inflation.

“With surging commodity prices and heightened inflation worries, there is growing concern that consumer spending will be impacted,” said Clarksons Platou Securities analyst Omar Nokta last week. “We see an uncertain outlook emerging, particularly for demand.”

2022 vs. 2021: Port congestion

Another difference versus the last big COVID incident in China: Port congestion is worse now.

In May 2021, prior to last year’s Yantian closure, there were 19 container ships per day, on average, waiting for berths in Los Angeles and Long Beach. As of Monday, there were 43 (including ships both inside and outside port waters).

The good news is that this is less than half the record high of 109 ships waiting on Jan. 9. The bad news, according to Sea-Intelligence, is that the drop was driven by fewer ship arrivals from Asia, a trend it says is about to sharply reverse.

Volume has also switched to other North American ports. During the quarterly conference call last week, executives of ocean carrier Zim (NYSE: ZIM) highlighted market shifts toward Vancouver, British Columbia, as well as East Coast ports.

Vessel-positioning data from MarineTraffic showed that as of Monday morning, 11 container ships were waiting off New York/New Jersey; one off Philadelphia; 11 off Virginia; two off Savannah, Georgia; 24 off Charleston, South Carolina; one off Mobile, Alabama; 11 off Houston; one off Seattle/Tacoma; 14 off Oakland, California; and 19 off Vancouver. Five container ships (including a Zim ship) declaring Vancouver as their destination were anchored off Hokkaido, Japan.

Add that to the Los Angeles/Long Beach queue and there are still over 140 container ships off North American ports at a time when COVID is once again threatening to disrupt the trans-Pacific supply chain.

Click for more articles by Greg Miller

Related articles:

- Just how extreme is China’s lead in the container port business?

- Shipping mints even more money as supply chain squeeze drags on

- How invasion of Ukraine could ease shipping logjam off US ports

- Supply chain whack-a-mole: West Coast eases, East Coast worsens

- Glimmer of hope: Has the ship gridlock off ports finally peaked?

- Shipping giant Maersk could rake in $50 billion over just two years