Lost volumes continue to mount as less-than-truckload carrier Yellow Corp. rationalizes its network and overhauls operations.

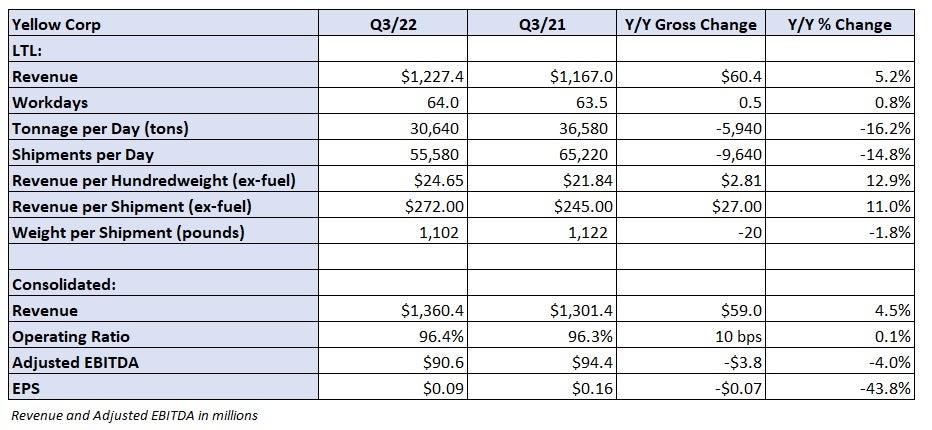

Tonnage during the third quarter was down 16.2% year over year (y/y), with declines easing as the quarter progressed — down 17.2% in July, 15.7% in August and 15.8% in September. However, preliminary indications for October show that tonnage was down 24% y/y.

A 6% to 7% sequential tonnage decline from September to October outpaced typical seasonal trends, which produce only a 4% decline in most years.

On a two-year stacked comparison, Yellow’s (NASDAQ: YELL) tonnage was down 25.6% in the period. October marked the 17th straight month of y/y declines.

Yellow used a favorable freight environment to swap out less desirable, lower-margin freight. The company has also been executing a plan to eliminate redundancy by consolidating its separate LTL brands. Phase one of the restructuring included 89 terminals. An additional 200 sites are expected to be integrated by the end of the year.

The company expects to see improved fluidity throughout the network and reduce costs in its linehaul and pickup and delivery operations. A total of 28 terminals, 6% of total doors, will be sold. The proceeds will be used to chip away at $1.6 billion in debt.

“I’m not interested in culling any more tonnage at this point,” CEO Darren Hawkins told analysts on a Wednesday evening call. “It’s been the right strategy for our company … on the road to profitability that we’ve been on. With the demand environment that we’re seeing right now, we’re certainly going to protect our yield and we’re going to prioritize profitability through the process.”

Hawkins noted demand from its retail customers pulled back in October. However, the bulk of Yellow’s freight comes from industrial-based customers where demand “is still firm.”

Revenue per hundredweight, or yield, was up 24.6% y/y in the quarter. Excluding fuel, the metric was 12.9% higher. Management said contract renewals were up 5% during October. Yellow also implemented a 5.9% general rate increase on tariff codes beginning Oct. 3.

The operating ratio deteriorated 10 basis points y/y to 96.4%. However, 140 bps of the degradation was tied to a $19.4 million increase in third-party liability claims expense. The matter appears to be resolved and unlikely to recur.

Earnings per share were 9 cents, well below the consensus estimate of 58 cents and the second quarter’s $1.15. Unfavorable claims expense was a roughly 30-cent headwind. The period did benefit slightly from a $1.1 million gain on the disposal of property.

Yellow announced changes to its asset-based loan facility. It extended the maturity by two years, raised borrowing capacity by $50 million to $500 million and lowered the fixed portion of the rate by 50 bps.

The capital expenditures budget was lowered to a range of $210 million to $230 million from $250 million to $300 million previously. The timing of equipment spend has been adjusted as the carrier is transitioning through a period of lower volumes. None of the guidance reduction was due to OEM production delays.

Hawkins on the network consolidation: “The early results are meeting expectations, and customers benefit by having one driver pick up and deliver both regional and long-haul shipments. We expect the network optimization to lead to improved asset utilization, enhanced network efficiencies, cost savings and to create capacity without the need to add new terminals.”

Shares of YELL were down 7.6% in after-hours trading Wednesday, following an 8.7% decline in Wednesday’s trading session. The S&P 500 was off 2.5% on the day.

More FreightWaves articles by Todd Maiden

- Transportation capacity hit high-water mark in October, survey says

- Done deal: XPO completes spinoff of brokerage unit RXO

- ArcBest to contend with tonnage declines, cost inflation in Q4